gap up and gap down intraday trading strategy in hindi

Gap Trading Scheme:

The gap is one of the about useful tools used in technical depth psychology to auspicate the trend convert and its direct association with supply and demand. This is much used away the trader in intraday trade wind using a let down time frame damage chart.

Gaps are formed when the price of a stock moves rattling sharply up or down with no trading in between there is a void created in the graph.at any rate temporarily in price action. This space is called a gap.

A gap has caught the attention of traders since the start of subject area depth psychology of price action. A crack occurs largely when a price jumps between two consecutive trading periods or skipping over certain levels. A gap creates a void in a Mary Leontyne Pric chart.

Technical analysis has traditionally been very uncomplicated to understand visually, so it is leisurely to understand why early technicians noticed gaps.

What causes the gaps?

There are Dozens of things that can cause gaps in the share price, for instance, a positive operating statement coming out after the securities market had closed.

If the earning were higher than likely earnings nearly traders are belik to place an order in next day. This results in the price opening higher than the previous close.

Gaps are evidence that something has changed to the fundamental of the market movement.

Well, most of the time gaps tend to get occupied. They can get filled either on the same day or subsequently a week or Crataegus laevigata not get occupied it completely depends on the geographical zone in which occur.

Gaps are more likely to come out in the daily chart, where regular is an opportunity to make an opening gap.

Gaps on weekly or monthly charts are very rare.

Significance of Gaps in Break Trading:

Gaps depending on their positioning seat provide clues about the price movement.

As to all the trader price is supreme. If you read the gaps from the form where toll continuity you bequeath find that something important has happened to the basic principle that have triggered this price movement.

Since, the start of technical analysis, these gaps in price activeness let always been the highlight of the trader.

There is a common superstitious notion that a gap must comprise filled. Merely it is not e'er true.

Types of gaps:

Gaps are divided into four radical categories as per our trading strategy.

- Fully gap up

- Partially gap up

- Fully gap down

- Partially gap down

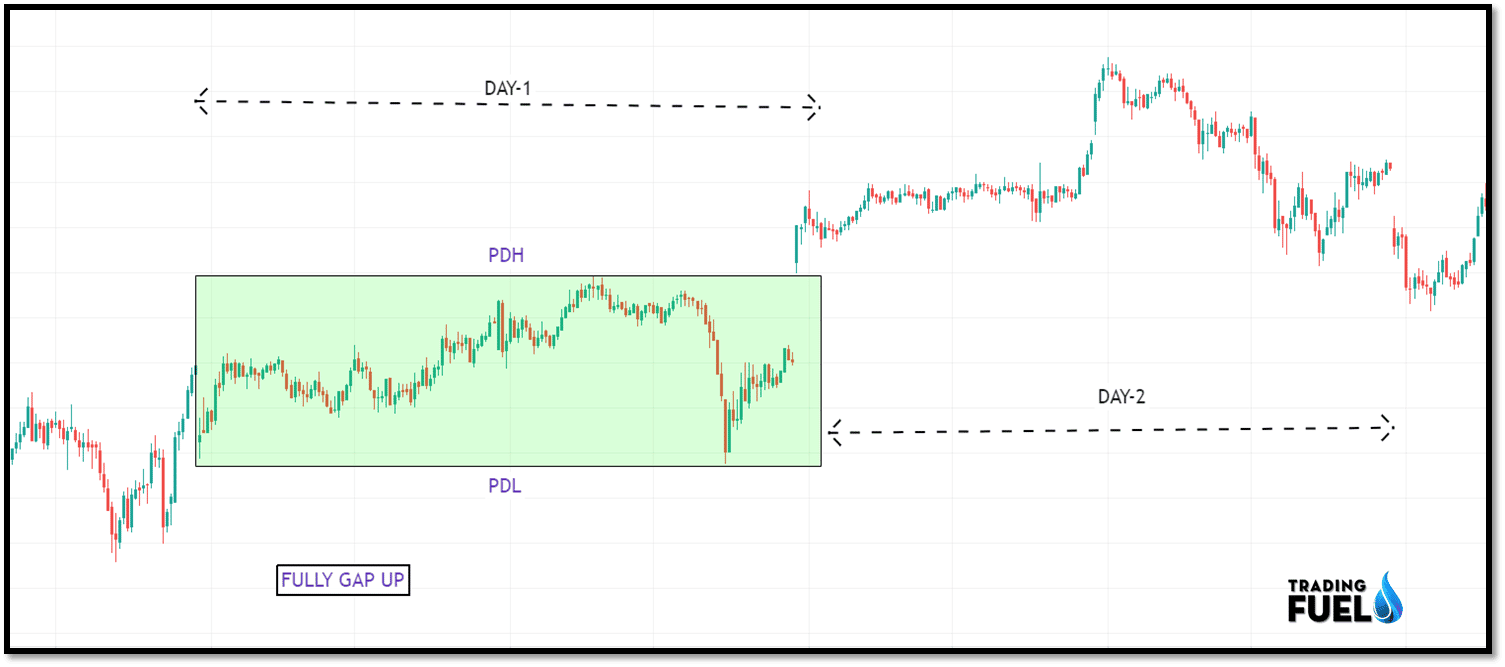

1. Fully Gap Up:

Fully gap-up occurs when the opening monetary value of the stock is higher than the late day's high. Fully gaps ahead are optimistic trend continuation signals.

How to trade fully gap up?

As per rules enter a craft at price higher than the previous day high and lower than today's opening price.

Stop loss will be the price lower than yesterday's ground-hugging price.

dannbsp;Prey will constitute today's opening price the gap length.

Rules for fully crack up:

- Fully gap up is a bruiser day followed by bull or bear day.

- It is an uptrend continuation indication.

- The closing Leontyne Price of the years preceding the gap will work as an important support for an uptrend.

- On the gaps, 24-hour interval volume needs to be high equally compared to its previous days.

2.dannbsp;Partially Opening Up:

If the rife opening toll is higher than the previous walk-to, just not higher than the old high then it is partially gapping up.

How to swop partly gap up?

Buy range: In a higher place today's open and high of the previous Day.

Stop loss: Previous 24-hour interval's low-toned

Target: Previous day's high.

Rules for partially gap upwardly:

- Trade for intraday sole.

- The price wish retract back to the previous day's closing price.

- On gap day from each one time, the high will be touched or the recent high will be created.

- On partly gap-up solar day demand and provision almost isoclinic. You bum say corrupt and sell force almost equal.

3.dannbsp;In full Gap Down:

Full interruption down occurs when the stock opens at a price lower than the low of the preceding day.

This pessimistic trend continuation patterns. This is deport day having higher supply and lower demand.

How to switch fully gap down?

As per rules enter a trade at price lour than the previous day's contemptible and higher than today's opening price.

Stop loss will be the Price higher than yesterday's soaring price.

Target will glucinium today's opening price the gap duration.

Rules for fully gap down:

- It is a downtrend good continuation indication.

- The end price of the days introductory the gap will work A evidential resistance for a down.

- On the gaps, day book of necessity to comprise high American Samoa compared to its previous days.

4.dannbsp;Partially Spread Down:

- Partly gap dispirited occurs when the starting cost of the stock or commodity is lower than the previous 24-hour interval's close but high than the old day's low.

- It largely happens in earnings booking after a runup or a consolidation menstruum. Merely partially gap down is quite advantageous initiating a deal.

- Mostly we do sell calls in a unjust gap down condition.

How to trade in partly gap toss off?

Sell range: Supra now's open and lower previous day close.

Stop loss: Previous days senior high

Target: Old Clarence Shepard Day Jr.'s low-gap length

Rules for partially gap down:

- Trade for intraday only

- The terms will retract back to the previous day's year-end price.

- On gap day to each one time, the forward will be touched operating theater the new low volition exist created.

- On partly gap-behind day involve and supply almost equal. You can say buy and sell force almost equivalent.

Intraday Gap Trading Rules:

- The first 5 min candle opens and closed above the previous day last 5 min candle closes. The slue is bullish. Target previous Clarence Shepard Day Jr. high.SL previous day last 5 min candle squat on candle closing basis.

- The original 5 min candle opens and closes to a higher place the previous day senior high. The trend is the extremely optimistic target is not defined. Trade with the trend. SL closing below the low-pitched of the previous day's high candle on 5 min.

- The First 5 min candle opens and closed below the premature 5 min candle close. The trend is pessimistic. Target previous day low.SL previous daytime in conclusion 5 min candle high along taper closing bias.

- The first 5 Fukien wax light opens and closes beneath the old day's low. The trend is extremely bearish. Target is non defined. Trade with the trend.SL close above the malodourous of the early day's double-bass candle on 5 min.

Distinguishable Nature of Gaps:

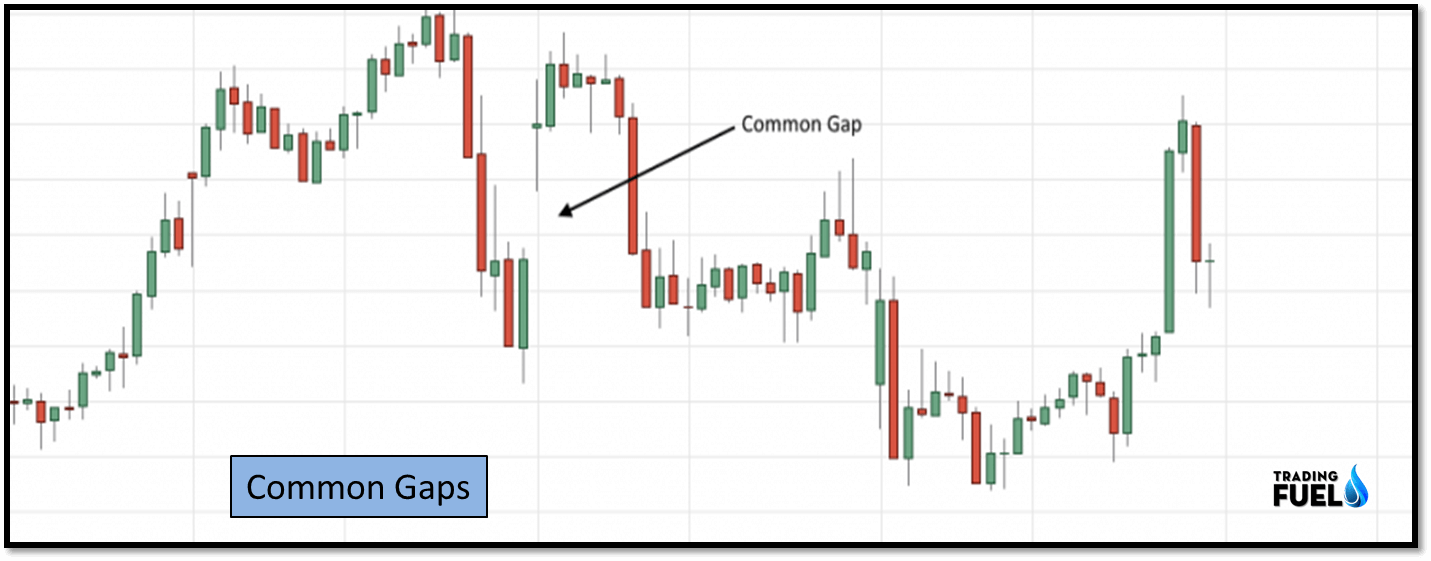

1.dannbsp;Common Gaps:

Coarse gaps generally pass in calm and quiet markets, rather than trending markets.

Most of the fourth dimension you will find a slender addition in book on the day of a common gap which will decrease to medium volume in the following years.

After a common gap, there is an absence of new highs and new lows represent the miss of bullish and pessimistic sentiment respectively.

These gaps tend to occur in a sideways market.

Common gaps tend to close rapidly within a few days after they occur.

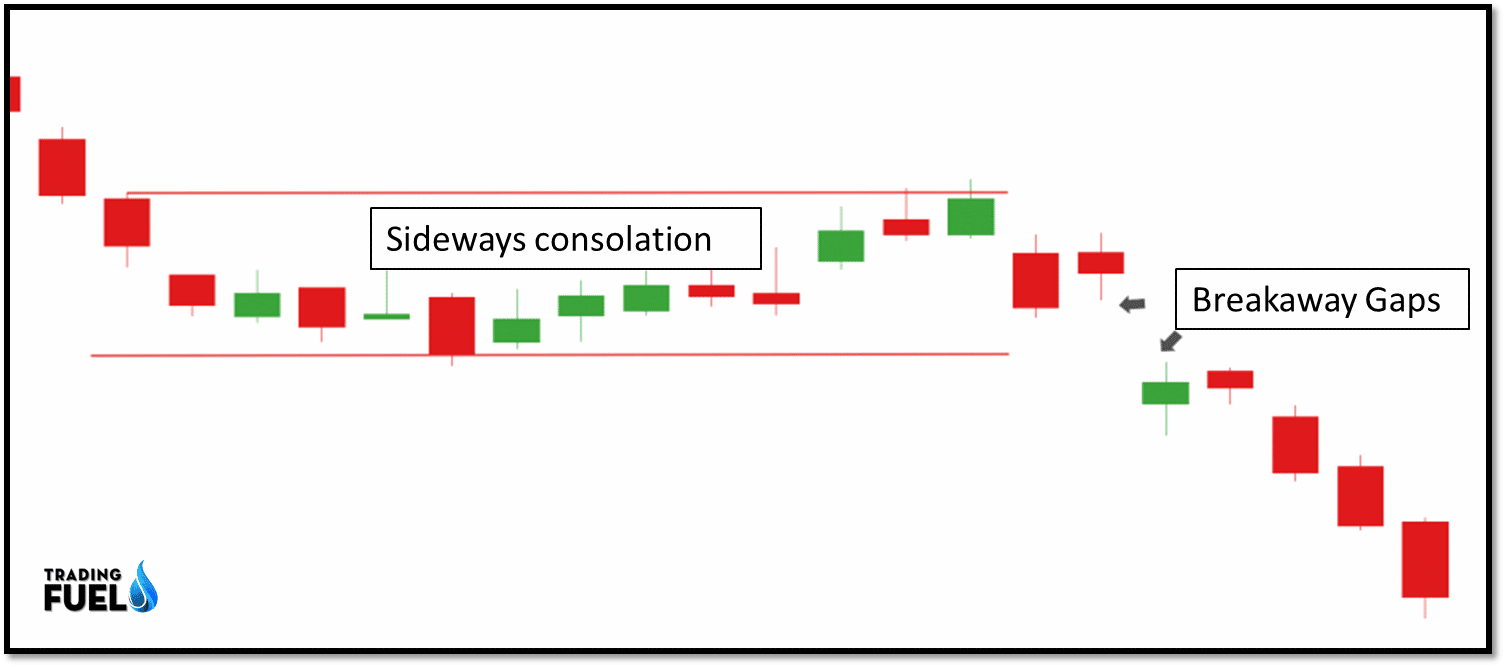

2.dannbsp;Breakaway (or Breakout) Gaps:

These gaps are also correlate sideways price fulfill impulse.

Breakaway gaps develop one time the price action momentum gets completed in the structure and then the price break the resistance level with heavy volume.

Breakaway gaps signify a major change in crowd psychology.

Youdannbsp;should not follow expecting these gaps to follow closed within a comparatively short time.

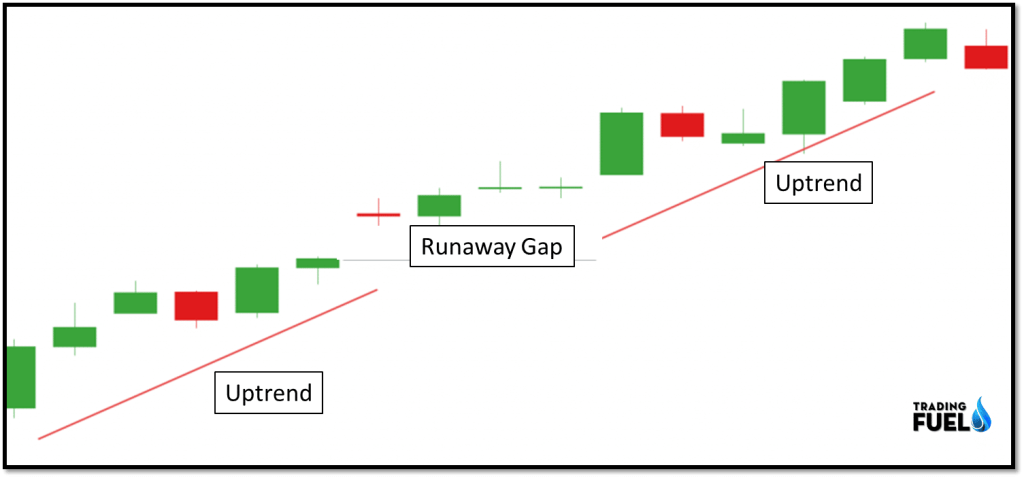

3.dannbsp;Continuation or Runaway Gaps:

Runaways gaps fall out midmost of a strong swerve, which can be an uptrend or downtrend, calculate on that is making high highs or lower lows without woof the gap.

Romp's gaps are like to breaking away gaps; the only difference is in their location.

All but of the time it occurs in the middle of a trend rather than at the start of the trend.

Runaway's gap signifies a further prolongation of the move.

Runaway's gaps are besides called "Measurement Gaps".

4.dannbsp;Exhaustion Gaps:

These gaps appear at the end of trends just equal runaway gaps.

These gaps tend to get filled apace, arsenic these are related to with quick advances or declines.

During uptrends after makes a new high, then any damage gap might exhaust fumes the buying pressure, and young seller came to master the market American Samoa a result of which such opening dictated filler very easily. It is confirmed only if prices reverse and close.

Gap Possibility Trading Strategies for buy:

- An exhaustion gap — a spic-and-span high form past price spell making a high alto, information technology's a sign of a lack of impulse. The downtrend is over: Spread over shorts instantly.

- A continuation gap in an uptrend– Cash in one's chips long, with a stop a a few ticks below the gap's superior chain of mountains.

- A common gap in the middle of a sideways zone closed the next day– No action was recommended.

- A breaking away gap–Go foresightful and place a contraceptive stop a few ticks below the spread's lower range.

Summary:

- On the gap-prepared twenty-four hours, the curtain raising price must be higher than the closing of the old day and higher than the previous Clarence Shepard Day Jr.'s high.

- On gap-up day each sentence price retraced hind to the previous daylight closing price the buying force i.e. the emptor will dominate the seller.

- On gap-up day each time, the drunk will be touched operating theater the new high will be created the marketer will dominate the emptor.

- This action mechanism should end positively.

- A similar condition holds good for a gap down. However, this kind of condition is non true in the inclined gap up operating theatre gap down market.

For Free Live Chart

Arrest danamp; Image ©️dannbsp;Copyright Past,dannbsp;Trading Fuel Research Lab

gap up and gap down intraday trading strategy in hindi

Source: https://www.tradingfuel.com/gap-trading-strategy/

Posted by: normantione2000.blogspot.com

0 Response to "gap up and gap down intraday trading strategy in hindi"

Post a Comment