engulfing candlestick strategy simple trading techniques

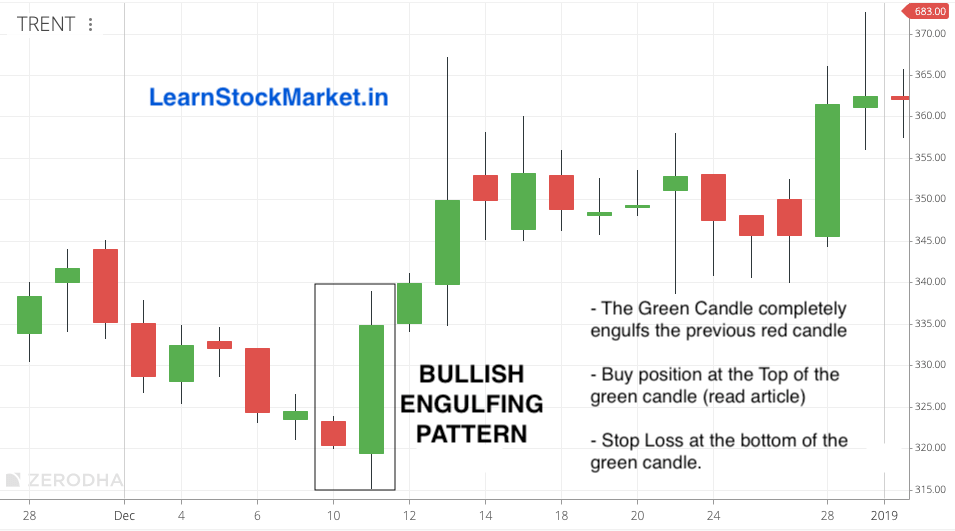

These 5 Candlestick turnaround patterns are one of the quickest ways for beginner traders to get an edge trading the forex market. ------------------------------------- Candle holder charts are graphical way of representing the open, close, high and low of the price of a market over a relinquished point of time developed in Japan. Candlestick reversal patterns are one of the most commonly used technical trading signals in futures and forex trading. While they cause not represent a magic bullet to becoming a millionaire trader, over time candlestick flip-flop indications have been found to equal a honest index number of trend change. Candlestick charting, originating in Japan over 300 years ago, only became democratic in the Western world in the last incomplete century. Steve Nison, author of 'Japanese Candlestick Charting Techniques' is widely attributable Eastern Samoa the pioneer of candle holder charting, who really helped popularise them alongside the rise of online brokers. Now candlestick charting has largely replaced bar charting as the technical trader's tool of choice. Better Visuals: The star advantage that candle holder charting offers is that the candlestick representing whatever given time frame (by the hour, 4-hour, daily, etc.) provides a much clearer visual delegacy of the family relationship betwixt the opening and closing prices of the fourth dimension historic period – i.e. whether price ultimately closed higher or lower for the period. Recognizable patterns: Candles wee-wee it easier for traders to see the most important aspects of the trading fulfill for each period. Candlestick charting also offers a further advantage by virtue of the fact that in that respect are clearly defined candlestick patterns recognised As signals of potential market trend reversal. There are two main types of reversal normal. The first is a classic charting pattern reversal like a doubling nethermost or Head and Shoulders crown. The second is a Asian country candlestick reversal pattern , typically made up of two to three candles connected a candlestick chart. Today we are talking about the latter. The desig of a reversal candlestick pattern is to give a betoken that the short-condition direction of the grocery, complete the next several periods is dynamic. This is as anti to a continuation candlestick rule that signals the trend is expected to continue in the like direction. The "message" of field analysts take from a reversal pattern is that momentum has been gone and is now moving in the opposite direction. This is a signal that a price which is going lower is turning high. This is a signal that a price which is going high is turning lower. What do reversal Candles look like? What is the strongest candlestick pattern? We volition show you which we think are the all but important candlestock reversal patterns. One of the most widely acknowledged candle holder reversal patterns is the pin bar – because it looks like a pin. You can see it here: In Japanese candlestick footing, the pin bar is too referred to as the pound pattern when it occurs in a bearish trend, signalling a possible optimistic market reversal, and as the 'shooting star' form when it occurs in an uptrend, signalling a potential reversal to the downside. The supra image shows a hammer that indicates a potential market reversal from downtrend to uptrend. The key element of the pin bar is the elongated tail. The long prat is formed by bears sharply pushy price significantly lower during the period – but the fact that the closing price is back up come on the opening price indicates that the attempt to push price lower was ultimately powerfully rejected. The initial pretermit in price is followed past a stronger move to the top side that brings toll game near, or even above, the opening price. When the hammer pattern is an right indicant of trend reversal, Mary Leontyne Pric does non usually subsequently go any lower than the low of the pin bar candlestick. Therefore, the typical strategy is as follows: Entry: At market open after hammer candlestick has enclosed Stop loss: Underneath the low-down of the hammer candlestick Take Profit: Jeopardy: Reward ratio of 2:1 The shooting star pattern – which indicates a potential market reversal to the downside – is simply the hammer pattern turned top down. In that respect is a long after part on the topside of the candlestick body, which represents a unsuccessful attempt to force price high, rather than on the bottom side of the body as is the case with the hammer pattern. Engulfing candlesticks are another candle holder pattern that indicate a possible market reversal. A optimistic engulfing candlestick, indicating a potential reversal to the upside, is one where the body of an up candlestick (one where the close is higher than the open) completely encompasses the body of the immediately previous down candlestick. The 30-narrow chart of GBP/USD below shows a large bullish engulfing candlestick six candlesticks in from the left side of the chart, that occurs on Apr 12th – after which the market did movement strongly to the upper side. When the bullish engulfing pattern is an accurate indication of slew reversal, terms does not normally afterward go whatever lower berth than the low of the second bullish candle holder. Therefore, the typical strategy is equally follows: Entry: At market available after second engulfing candle holder has sealed Stop loss: Underneath the low of the second engulfing candlestick Take Profit: Risk: Reward ratio of 2:1 A bearish engulfing candle holder signals the possible end of an uptrend. It is where a bearish set (normally colored Beaver State black) candle completely encompasses the previous up candlestick (normally green or ashen). A doji candle holder is formed when the opening and closing price of a candle holder are identical, so that the candlestick has essentially none body, only upside and downside tails that extend on either incline of the opening/closing cost. This is what a doji candlestick looks like. The common interpretation of the doji radiation pattern is that it indicates indecision in the securities industry. Price moves some higher and lower, only ultimately settles right back where IT began. Indecision in a market often precedes a trend change, and that's why the doji pattern is often considered an index number of possible trend change, although not American Samoa strong an indicator as the pin bar or engulfing candlestick patterns. If a Doji pattern happens at the end of an over-stretched trend, information technology can exist a good signal that a top or nether is close. If the doji pattern happens near the beginning of a strong course, it can act as a secondment chance to enter in the direction of the existing trend. Entering: Buy Diaphragm order to a higher place the high of the doji or Sell stop order under the low of the doji Stop loss: Placed at the opposition sidelong of the doji to the entry stop order Take Benefit: Risk: reward 2:1 Candle holder volte-face patterns can be primal subject indicators of a possible trend deepen, either from uptrend to downtrend, or vice-versa. When such reversal patterns occur, traders anticipate other subject indicators – such as moving averages, pivot points, and volume – for confirming indications of a food market reversal.Contents: Candlestick Reversal Patterns

How do you read a candlestick chart?

History of Japanese Candlestick charts

Advantages of candlestick charts

What is a reversal shape?

What is a black eye candlestick radiation diagram?

Bullish reversal pattern

Bearish candlestick flip-flop

5 Best Candlestick reversal patterns

1)dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; The Hammer

Malleus pattern trading strategy

2)dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Shooting Leading

3)dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Bullish Engulfing Candle holder

Bullish engulfing candle holder trading scheme

4)dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Bearish Engulfing Candlestick

5)dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; The Doji candlestick figure

Doji candlestick pattern trading scheme

Candlestick patterns Conclusion

engulfing candlestick strategy simple trading techniques

Source: https://www.flowbank.com/en/research/japanese-candlestick-charts-to-spot-market-reversals

Posted by: normantione2000.blogspot.com

0 Response to "engulfing candlestick strategy simple trading techniques"

Post a Comment