top binary option trading signals

Trading technical indicators with binary options tin exist a highly profitable trading style – if you know how to do it right. Our article explains the basics and iii examples of strategies that you lot can use. In detail, you lot will learn:

- What Are Technical Indicators?

- Why Are Technical Indicators And Digital Options A Great Combination?

- 3 Examples Of Strategies For Technical Indicators

With this information, you volition immediately exist able to trade binary options with technical indicators.

What Are Indicators?

Technical indicators are helpful trading tools that permit price activeness traders to understand what is going on in the market and make predictions about what volition happen next.

Some indicators describe their results directly into the price chart, which makes it easy for analysts to compare them to the current market price. Other indicators utilise a split window to display their results. The most well-known case of this blazon of indicator is oscillators. These indicators create a value that oscillates betwixt 0 and 100. This value and its change over time allow you to understand what happened in the past and what will happen next.

There are thousands of indicators, just these are the most important types and a few examples:

- Support & resistance: These indicators predict support and resistance levels at which the market place is likely to turn around. When information technology breaks through such a level, it will likely create a strong movement away from the price level. Examples: Lesser, Fibonacci retracement, Pivot indicate (PP), Top.

- Tendency: These indicators assistance you evaluate the strength and trustworthiness of trends. Examples: Average directional alphabetize (A.D.10.), Commodity channel index (CCI), Detrended price oscillator (DPO), Know certain thing oscillator (KST), Ichimoku Kinkō Hyō, Moving average convergence/divergence (MACD), Mass index Moving average (MA), Parabolic SAR (SAR), Smart money index (SMI), Trix Vortex Indicator (VI).

- Momentum: These indicators help you lot sympathize the momentum of a movement. Examples: Money flow index (MFI), Relative strength index (RSI), Stochastic oscillator, True strength index (TSI), Ultimate oscillator Williams %R (%R).

- Volume: These indicators utilise the trading volume (the number of assets sold or bought) to evaluate whether investors are more than bullish or bearish. Examples: Accumulation/distribution line, Ease of motility (EMV), Force Index (FI), Negative volume index (NVI), On-balance volume (OBV), Put/call ratio (PCR), Volume–toll trend (VPT).

- Volatility Indicators: These indicators measure the strength of a movement, which helps traders to make a variety of predictions, specially for binary options types that utilize target prices, for instance one touch options, boundary options, or ladder options. Examples: Average true range (ATR), Bollinger Bands (BB), Donchian channel, Keltner aqueduct, CBOE, Marketplace Volatility Index (VIX), Standard deviation (σ).

There is no need to learn all of these indicators. Accept a look at each category, choose the one that you like all-time, and take it from there. It is best to start with an indicator that you truly sympathise and like. Later yous can add more indicators to your strategy, allowing your trading to evolve naturally.

Why Do Indicators Accommodate Binary Options?

Nearly binary options traders rely heavily on technical indicators. At that place are mainly three reasons for this strong connection between binary options and technical indicators:

- Technical indicators simplify price activeness analysis. Cost action is the only way to predict what volition happen on such short fourth dimension frames equally you use within binary options. Just looking at toll movements tin exist confusing, though. Technical indicators can filter the most important information of a price chart and display it in a fashion that anybody can immediately understand. This simplification makes your trading quicker and easier.

- Indicators secure your trading. When you lot analyze the market without any help, there is a lot of information to take in. Complexity leads to mistakes and bad decisions, both of which cost y'all coin. Technical indicators eliminate these mistakes, which is why they aid you brand more money in a simpler way – a great combination.

- Indicators can reveal things no trader can. Within a dissever second, technical indicators analyze hundreds of datasets, filter out the well-nigh relevant information, and brandish information technology in a way that everyone can understand. Without the assistance of technical indicators, most of this information would exist inaccessible. It would have years to summate the Bollinger bands for fifty assets with ten time periods each. Technical analysis adds layers of information to your trading that would accept been hidden otherwise.

These points are the reasons why technical indicators and binary options are such a great combination.

What Are Leading Indicators?

Leading indicators are a special form of market indicators. Market indicators are everything that helps you understand whether the price of an asset will rise or fall in the futurity. They provide an of import, helpful, and like shooting fish in a barrel-to-interpret tool of for binary options traders. With the right strategy, they can help you conceptualize new market place movements and notice the platonic timing to invest.

These indicators can exist categorised into two types:

- Leading indicators. This type of indicator predicts what will happen to the price of an asset.

- Lagging indicators. This type of indicator tells you what has happened to the cost of an nugget. While this information is supposed to help you predict what volition happen side by side, the indication itself focuses on the past – this is the big difference between both types of indicators.

The goal of leading indicators is to requite you a sense of where the price of an asset is heading. A great instance of a leading indicator from another field is the business concern climate index. Business managers report their expectations for the future, and the index creates an aggregated value that easily can exist compared easily to previous months and years. The value and its change over time help you to predict whether the economic system will improve or get worse.

Leading fiscal indicators do the same affair. They measure out something, and the resulting value tells y'all whether things will get better or worse.

Why Should I Use Leading Indicators?

Leading indicators serve a very important purpose: they can assistance you lot empathize whether an existing movement is more than likely to continue or to end shortly. With this indication, you can discover bully trading opportunities and avoid bad ones.

For example, assume that you detect an upwards movement.

- If your leading indicator tells you that the movement likely will go along, you know that this is the right time to trade a high selection.

- If your leading indicator tells you that the move likely will end presently, yous know that now is not the correct fourth dimension to merchandise a high option. You should either stay out of the market place or trade an choice that predicts the impending end of the motility.

For any trend follower, swing trader, and nigh anyone else, leading indicators add together important data to their trading way. They tin can assistance filter out bad signals, find new trading opportunities, and win more trades.

Popular Examples Of Leading Indicators

There are hundreds of leading indicators. Some of them are similar, some very dissimilar. To help you sympathize leading indicators better, nosotros volition now accept a look at three different examples of leading indicators that let you to become a good experience for the different types of leading indicators.

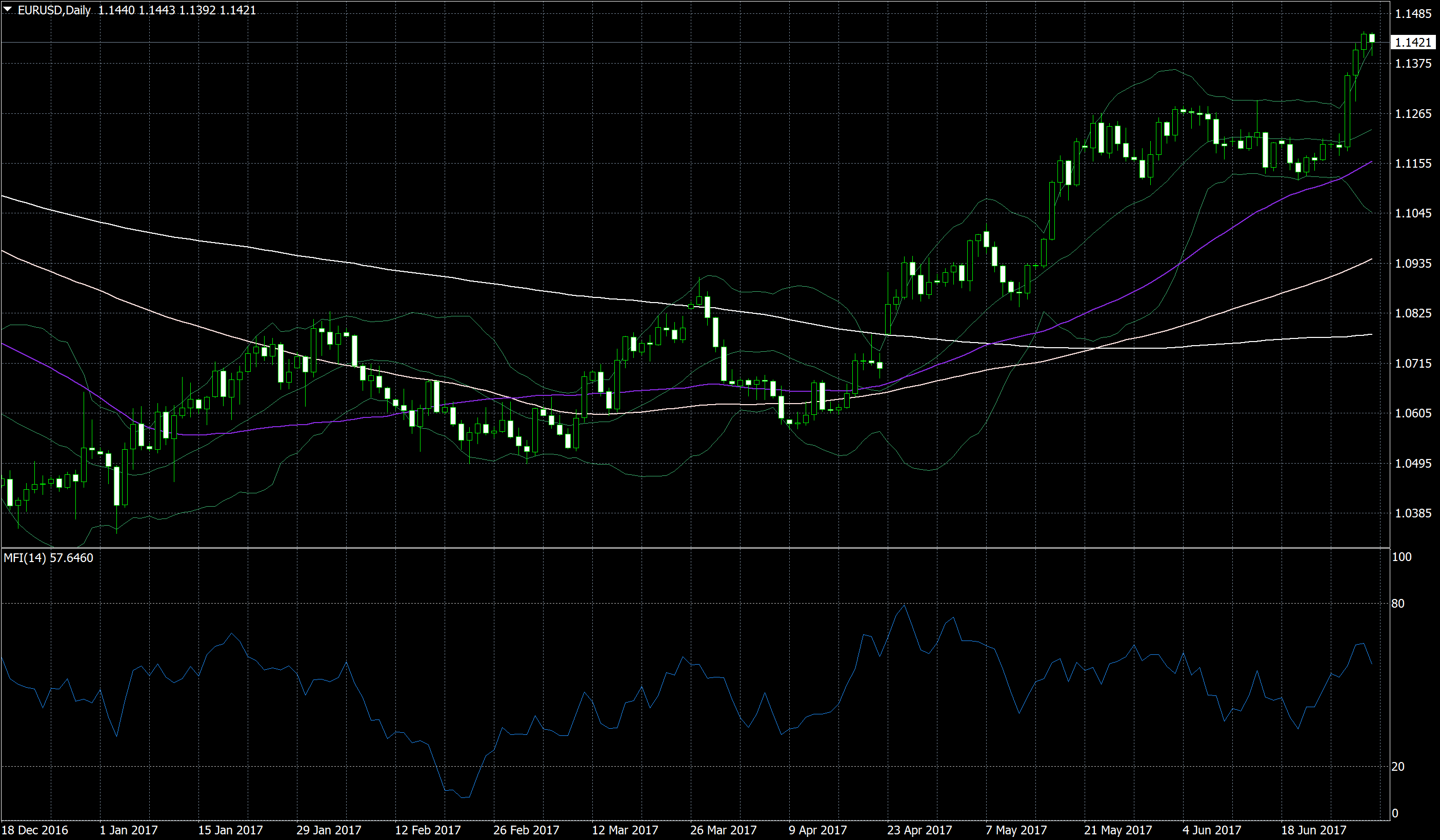

Example 1: The Money Flow Alphabetize (MFI)

The Coin Flow Index (MFI) is such a popular leading indicator because it helps traders speedily evaluate the strength of a trend.

Every bit the proper noun indicates, the MFI compares the coin that flows into an nugget to the coin that flows out of it. For this purpose, it multiplies the average of each period's high, low, and closing prices with the flow'south volume and then divides the sum of all periods with rising prices past the sum of all periods with falling prices.

The result is a value betwixt 0 and 100.

- When the MFI reads 100, all the money was flowing into an asset – all periods featured ascent periods.

- When the MFI reads 0, all the money was flowing out of an asset – all periods featured falling prices.

- When the MFI reads l, the number of sold and bought avails was exactly equal.

Every value over 50 indicates that more people sold than bought the asset, every value under l indicates the contrary.

The MFI'due south reading and its change over fourth dimension allow for ii predictions about future market movements:

- Extreme values. When the MFI is besides high (commonly over 70) or also low (ordinarily under 30), the market enters the farthermost areas. Traders assume that such extreme values indicate that too many traders have already bought or sold an nugget and that there are no more traders left that can buy or sell the asset and keep the movement going. Consequently, they predict that the movement is in problem and soon will either turn around or become through a consolidation earlier it tin continue. Some traders utilize this point to stop investing in the movement; some already invest in the opposite direction.

- Convergence/departure. When the market forms a new extreme in a trend (a new high in an uptrend or a new low in a downtrend), the MFI should mirror this movement and create a new extreme, also. When the MFI does not mirror the market'south new high/depression with its own high/depression, traders have stopped pushing the trend. While this was nonetheless plenty to create a new extreme, a continuing turn down in momentum would terminate the trade. Some traders would use this bespeak to stop investing in a trend, some to invest in the opposite direction.

Of course, y'all tin can besides translate the MFI in the opposite mode:

- When the MFI reads betwixt 30 and lxx, there is plenty room for the market place to continue its current movement. Most traders would predict that the motility will go on for a while and invest accordingly.

- When the MFI mirrors the current trend, the tendency is intact. Almost traders would predict that the trend will continue and invest appropriately.

The MFI is a leading indicator because it predicts that a trend or motility will continue or terminate soon. Lagging indicators would only tell yous what happened to a movement in the past.

Because the MFI's value oscillates betwixt 0 and 100, it is called an oscillator. Most other oscillators are leading indicators, likewise. If y'all like the idea of having a simple on which to base your investment decisions, take a look at other oscillators technical analysis has to offer.

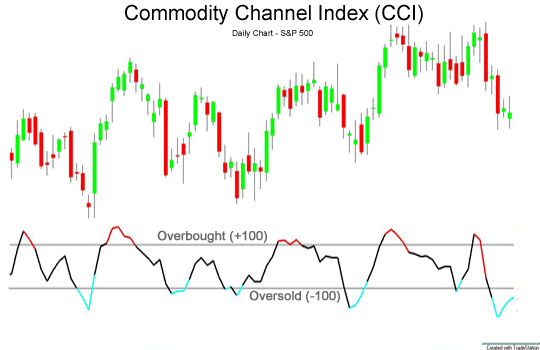

Example 2: The Commodity Channel Alphabetize (CCI)

Don't let the proper name fool you – the Article Channel Index (CCI) works with all types of assets, not only commodities.

Simply put, the CCI calculates how far an nugget has diverged from its statistical mean. The theory is that when an nugget has strayed also far from its hateful price, information technology will soon have to come up back. Just similar with MFI, the CCI assumes that when besides many traders have bought or sold an asset, there is nobody left to button the market further in this direction. Information technology has to turn around and consolidate.

In particular, the CCI multiplies the terminal complete period'south average of high, low, and closing price with 0.015 and puts the result in relation to a smoothed moving average.

- Values over 100 indicate that the asset is trading higher than one.015 times of the moving average'southward value.

- Values under -100 indicate that the nugget is trading lower than 0.985 times of the moving average's value.

In both cases, the CCI predicts that the market has moved besides far from the moving average and that the motion will soon plow effectually.

Some traders as well expect before they invest.

- When the CCI has risen over 100, they wait until it starts to fall before they invest.

- When the CCI has fallen beneath -100, they wait until it starts to rise before they invest.

These traders apply the CCI more as a lagging indicator. To utilise the CCI as a leading indicator, you have to invest when the market place crosses the +100/-100 lines – then yous invest in anticipation. When yous merchandise the changing direction, you invest in reaction and use the CCI as a lagging indicator.

Sometimes the line between lagging and leading indicators tin can be thin. Equally long as you know the difference and trade accordingly, you should be fine.

Example iii: The Relative Strength Index (RSI)

On beginning glance, the Relative Strength Index (RSI) appears to be pretty similar to the Money Flow Index (MFI). Both are oscillators, create a value between 0 and 100, and use an overbought and an oversold area.

The departure betwixt both indicators is that the RSI focuses solely on price alter while the MFI also considers the book of each menses. While the RSI treats every period equally, the MFI puts more than weight on periods with a high book and less weight on periods with a low volume.

Other than that, yous can employ the RSI just like the MFI. Trade divergences and the oversold areas above 70 or beneath xxx. When the RSI is between 30 and lxx the current move should however take some room; when information technology mirrors a trend, the trend is fine.

Neither the MFI nor the RSI is always better. Which indicator you should utilise depends on your strategy, your personality, and your behavior about the market.

- Some traders argue that they trade the toll, not the volume and that they, therefore, should ignore book. They also say that the volume is too similar on the curt time frames of binary options to accept an effect. These traders should use the RSI.

- Some traders argue that the volume does have a significant effect because it tells you which direction more traders back up. These traders should use the MFI.

How To Trade Leading Indicators With Binaries

All leading indicators can be the sole ground of your trading strategy or an additional characteristic to your current strategy to filter out signals. We will present strategies that use leading indicators in both ways.

Strategy i: Trading The MFI Divergences With Loftier/Low Options

We already pointed out that the MFI mirrors an intact trend.

- When an intact uptrend creates a new loftier, the MFI creates a new high, likewise.

- When an intact downtrend creates a new depression, the MFI create a new low, too.

When the MFI fails to mirror a trend'south new extreme, the trend is in trouble. The trend is losing momentum, and while it nonetheless had plenty power to create new extreme, it seems that this was the trend'southward last extreme.

High/depression options offering you the perfect tool to trade this prediction.

- When the MFI diverges in an uptrend, invest in a low option.

- When the MFI diverges in a downtrend, invest in a high choice.

The important part of this strategy is getting the death right. While it is highly probable that the market volition follow an MFI divergence by changing management or entering a sideways movement, these movements take time to develop. It is of import that you choose your death long enough to provide the market with this time.

When you find an MFI divergence in a five-minute chart, for instance, an decease of 15 minutes would be insufficient. The market volition take at least 10 periods to turn effectually, and a 15-infinitesimal expiry would only be the equivalent of iii bars. Cull an death of 1 hour, and you lot increase your chances of winning the trade.

You can also trade this strategy with the RSI. You would merely switch indicators, without changing anything else.

Additionally, you tin can supervene upon loftier/low options with depression-risk ladder options. Ladder options piece of work just like loftier/low options but allow yous to use a price other than the electric current marketplace price as the reference betoken for your prediction.

- After an MFI divergence in an uptrend, you predict that the market place will trade lower than a price that is higher up the current marketplace price.

- Later an MFI divergence in a downtrend, yous predict that the market volition trade higher than a cost that is beneath the current market price.

This is the safer version of the strategy. Instead of using the current market price as the reference point for your prediction, you use a toll that is farther in the direction from which you expect the market to move abroad. This strategy volition win you a higher per centum of your trades merely also get you a lower payout. Decide for yourself which strategy you want to utilize.

Strategy two: Filtering Trends With The RSI

A trend following strategy follows a unproblematic principle:

- In an uptrend, invest in rising prices.

- In a downtrend, invest in falling prices.

Despite this simplicity, many traders are afraid that they might invest in a trend that volition end before long. These traders can use the RSI to filter signals.

- When the RSI has mirrored the trend, invest in the tendency.

- When the RSI has diverged from the tendency, do not invest in the trend.

The addition of the RSI to a trend-following strategy can assist traders to win a college percentage of their trades and make more than money with a simple check.

Keep the residuum of your strategy unchanged. Use the same expiry every bit before and invest the same percentage of your overall account balance per merchandise.

Strategy 3: Trading the MFI's extreme areas with high/low options

In add-on to divergences, the MFI also creates a prediction when a movement enters an farthermost expanse. This prediction allows for a uncomplicated trading strategy:

- When the MFI enters the overbought area, invest in a low option.

- When the MFI enters the oversold area, invest in a depression pick.

The success of this strategy depends on your ability to choose the right decease. The market will need some time to turn around, which is why you must avoid choosing a too short expiry. When you lot choose your expiry too long, on the other manus, the movement might be over by the time your pick expires.

Experience will assist you lot find the correct expiry. The perfect setting depends on the situation, the period of your chart, and the characteristics of the asset. If you are looking for a rough number with which to showtime, try around 5 periods, and then have it from at that place.

Similarly to the first strategy, you can also trade this strategy based on the RSI or with low-risk ladder options.

Leading Indicators – Summary

Leading indicators are an important, helpful, and like shooting fish in a barrel-to-interpret tool of market analysis. Binary options traders tin apply leading indicators as the sole basis of their strategy or to filter signals. They are specially helpful to find the right timing and avert bad trading opportunities.

What Are Lagging Indicators?

Lagging indicators are an of import aspect of any market place analysis strategy. This article explains everything you lot demand to know to trade binary options based on lagging indicators. You will also empathize their advantages, disadvantages, and ideal fields of use.

The difference between leading and lagging trading indicators is the same.

- Lagging trading indicators tell yous what happened to the cost of an asset in the past in a way that helps you to predict what will happen next.

- Leading indicators analyse another factor and predict how it will influence the price of an asset.

This difference is why lagging indicators are specially useful during trending periods. When the market is in a tendency, lagging indicators can assist yous make great predictions; simply when the marketplace is not trending, many lagging indicators utilize their predictive qualities.

Lagging indicators serve an important purpose and are a vital part of any market analysis strategy. To see how you tin employ lagging indicators for your trading, allow's take a closer wait at three popular examples of lagging indicators.

Popular Examples Of Lagging Indicators

There are hundreds of lagging indicators, simply permit's continue things unproblematic. Here are the three most pop lagging indicators every trader should know.

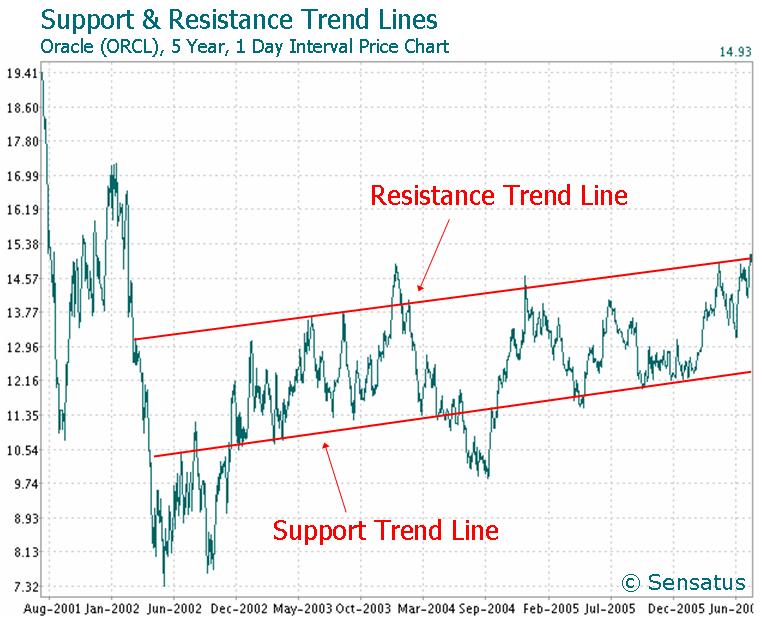

Example 1: Trends

The most popular example of a lagging indicator is the tendency. Trends are the zig zag movements that take the market to new highs and lows.

Trends are zig-zag movements because the market never moves in a straight line. Every once in a while, every movement has to take a pause to create new momentum. It is simply impossible for all traders constantly to keep buying.

This is why trends take two steps forward and i step back. The resulting zig-zag movements are easy to place and allow for accurate predictions.

- Uptrends continually create higher highs and lows.

- Downtrends continually create lower lows and highs.

A trend strategy predicts that the current trend is likely to go along.

- When the market place is in an uptrend, tendency traders invest in rising prices.

- When the marketplace is in a downtrend, trend traders invest in falling prices.

Some traders also trade every swing in a trend. A swing is a movement from loftier to low, and past trading multiple swings during a tendency, swing traders hope to increase their profit.

Of course, no tendency will continue indefinitely. But even with loftier/low options, yous would only need to win 60 percent of your trades to make coin. A well-executed trend strategy should hands be able to achieve this goal.

A trend is a lagging indicator because it tells you lot that the market place was in a trend over the last periods. While this knowledge also allows for predictions about what will happen next, the main indication of a tendency is based on past price movements.

Trends are also the most important lagging indicator. Most other lagging indicators lose their predictive abilities when the market is not trending, which is why a trend analysis should precede the use of other technical indicators.

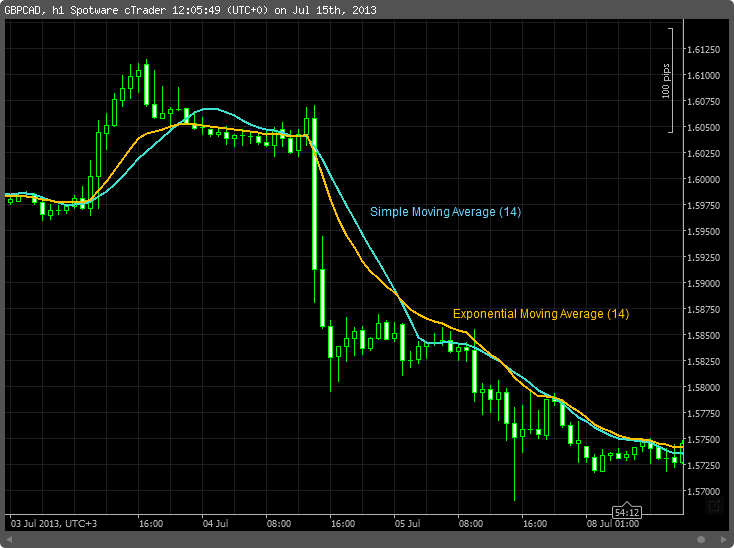

Example 2: Moving averages

Some other popular example of a lagging indicator is the moving average. A moving average calculates the average price of the last periods and draws information technology into your nautical chart. It then repeats the process for all preceding periods and connects the dots to a line.

The position and the management of a moving average can tell you a lot about what the price of an nugget has done:

- When a moving average points upward, the market must have risen over the concluding periods. When it points downward, the market must have fallen.

- When the market is trading higher than the moving average, the marketplace must accept risen over the last periods. When the market is trading lower than the moving average, the marketplace must accept fallen.

When both of these indications signal in the same direction, you get a good indication of what is happening.

- When the market is trading above a moving average and the moving average is pointing upwards, the market is likely rising.

- When the market place is trading below a moving average and the moving average is pointing downward, the market is likely falling.

These indications assist you to make a better investment decision.

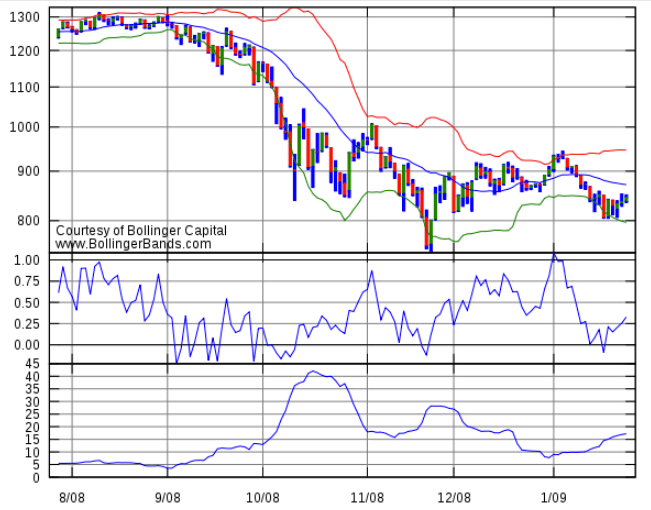

Example iii: Bollinger Bands

Bollinger Bands are a popular indicator considering they create a toll channel in which the market is likely to remain. This price channel consists of three lines or bands:

- A twenty-period moving average equally the centre line.

- An upper line two times the standard deviation above the middle line.

- A lower line ii times the standard difference below the middle line.

The market place always never leaves the outer ii lines of the Bollinger Bands. The heart line works as a weaker resistance or support, depending on whether the marketplace is currently to a higher place or below it.

Bollinger Bands can aid you lot to understand whether an asset'due south price is probable to rise or fall.

- When an nugget is trading near the upper range of the Bollinger Bands, it has little room left to climb whatever further. Consequently, it is likely to autumn.

- When an asset is trading most the lower range of the Bollinger Bands, it has little room left to fall any farther. Consequently, it is likely to ascent.

- When an asset is approaching the middle line, it is probable to have a break. Sometimes, the market will break through the centre line; sometimes, it will plow effectually.

These indications provide y'all with many trading opportunities.

Bollinger Bands are lagging indicators because they only tell y'all what happened in the past. The moving average and the standard deviation are both based on the last 20 periods. While information technology is likely that the market volition adhere to similar confides for the electric current menstruation, also, Bollinger Bands are unable to predict the trading range 50 periods from now. Then, the market environs volition have changed, and the trading range will be dissimilar.

Despite this limitation, Bollinger Bands tin can be a valuable part of your trading strategy. Nosotros volition later encounter how.

Why Should I Utilise Lagging Indicators?

Some newcomers to binary options question whether lagging indicators can assist them at all. They signal out that any trader has to predict what will happen next, and argue that indicators that tell you what has already happened are of footling help with this task.

These traders are mistaken. Lagging indicators tin brand valuable predictions and aid y'all gain deep insights into the market. There are two primary reasons why traders use lagging indicators:

- Lagging indicators are based on proven facts; leading indicators are not.

- Agreement what has happened helps you predict what will happen next.

Let's take a closer expect at these three advantages of lagging indicators.

Reward 1: Lagging indicators are based on proven facts, leading indicators are non

When a 50-period moving average is pointing upward, you know that the price of an nugget has risen more than information technology has fallen over the last 50 periods. This result is indisputable. Similarly, when the market is currently trading below the moving average, you knowthat the marketplace has recently picked upwardly some downward momentum.

This knowledge puts your trading strategy on solid feet. Especially conservative traders volition similar lagging indicators considering they provide them with a sure basis from which they can brand their decisions.

Leading indicators are unlike. The volume is a leading indicator, for case. A volume strategy predicts that a reducing volume indicates the impending cease of a movement. This might be truthful, but information technology is not sure, and information technology is impossible to show this connection – you take to believe it. While the volume is slowing down, the price movement itself can fifty-fifty advance. Sometimes, a reduced volume indicates an ending motility; sometimes information technology does not.

Simply put, lagging indicators focus on by price movements – which are known. Leading indicators imply that another gene volition influence future price movements – you tin can believe that there is a connection, and there might be, merely there are many other factors influencing the market, which is why it is incommunicable to say whether this connection influences the market place at all and whether it will influence the market place stronger than other connections.

Reward 2: Understanding what has happened helps you lot predict what will happen next.

Lagging indicators as well permit for predictions about what will happen next – they but practice and then indirectly.

Leading indicators imply that a certain factor will decide where the market place volition go side by side. Lagging indicators make no such assumption. They simply predict that what has happened before will continue.

When the market crosses a moving average, lagging indicators just tell y'all what has happened – the market has recently inverse direction. The unsaid assumption is that this movement will continue.

- If the marketplace fell for the last periods, information technology seems likely that the same factors that pushed down the market in the recent past volition likewise push button it downwardly shortly.

- If the market rose for the concluding periods, it seems likely that the same factors that pushed up the marketplace in the recent by volition also push button it up shortly.

Both predictions are tradable.

Generally, binary options trading requires you lot to sympathise what is happening right now. Since there are then many factors at work right now, it is impossible to say with is happening with absolute certainty. But agreement what has happened is an essential office of arriving at a tradable prediction that will exist right in enough cases to make you coin.

How To Merchandise Lagging Indicators

Let's become physical. Here are three strategies for how y'all tin can merchandise lagging indicators with binary options.

Strategy 1: Trade Swings In A Trend With Ane Touch on Options

Each trend consists of many swings. Each unmarried swing offers a great trading opportunity for one touch on options because it combines strong indications of direction and length of movement.

Every movement in the master tendency direction is followed by a movement in the opposite direction and vice versa. This unproblematic human relationship makes predicting the market's direction elementary once you lot recognize a swing.

Now, y'all could simply merchandise this bespeak with high/low options, but swings likewise let you to trade one touch options, which offer much college payouts but crave you to predict the length of the movement.

In a trend, swings in the main direction will always move at to the lowest degree as far every bit the last extreme.

- In an uptrend, the next upwards swing will reach at least the price level of the previous high.

- In a downtrend, the adjacent downwards movements will reach at least the cost level of the previous low.

Swings against the main tendency direction follow similarly articulate rules. The market normally reverses 1-third or two-thirds of the previous motility in the main tendency direction.

- In an uptrend, a downwards swing will reverse roughly ane-tertiary to two-thirds of the previous upwards swing.

- In a downtrend, an upwards swing will reverse roughly 1-third to 2-thirds of the previous downwardly movements.

With this knowledge, yous gain the articulate price target that you lot demand to trade a 1-touch option. Here'southward what y'all do:

- Wait for an ending swing.

- Determine the reach and the direction of the side by side swing.

- Bank check whether your broker offers you a one touch option with a target toll inside reach of this movement and a realistic expiry. If so, trade it. If not, trade a high/low option in the direction of the move.

At this point, information technology is important to mention that movements against the trend's chief management are commonly more volatile and take longer to develop. Many traders avoid trading reversals with one touch options and use loftier/low options instead. Decide for yourself how you want to trade reversals.

Strategy two: Merchandise The Market Crossing The Moving Average With High/Depression Options

When the market crosses a moving average, it has plain changed management. You tin predict that this new movement volition go along and invest in a high/depression choice in the direction of the movement.

- When the market crosses your moving average downwards, invest in a low option.

- When the market crosses your moving average upwards, invest in a loftier option.

The of import aspect of this strategy is that you lot choose the right expiry. For example, a 9-period moving average can never predict what will happen to the price of an asset over the next 50 periods. 50 periods and 9 periods are merely too different time frames.

To avoid making predictions that are impossible to make based on your moving average, always keep your expiry shorter than the amount of time that is the basis of your moving boilerplate. Ideally, you would utilize an decease shorter than half of your moving average.

Similarly, you should avoid using an expiry that is too short, or brusk-term marketplace fluctuations could cause you to lose your trade despite making a correct prediction. Use an decease that is at least one-quarter of the time that is the basis of your moving average.

For instance, when y'all use a moving average that is based on 20 periods and a price chart with a menstruation of 5 minutes, your moving average is based on 100 minutes (20 times 5). Ideally, y'all would trade this moving boilerplate with an death of 25 to 50 minutes. You could also become a little longer or shorter, only an decease of threescore seconds would be too short and one of 4 hours would be besides long.

Strategy 3: Trade Bollinger Bands With Low-Chance Ladder Options

Bollinger Bands indicate the market place's trading range, and ladder options allow you to predict which prices are outside of the market'south reach – this is a swell combination.

The success of this strategy also depends on choosing the right death. Bollinger Bands are lagging indicators, which is why they are unable to predict what will happen x periods downwardly the road. By then, the market place will accept changed, and the Bollinger Bands' indication will have changed with it.

To make sure that the Bollinger Bands in your chart create valid predictions for your option, you lot take to prepare the catamenia of your chart to the aforementioned value as your expiry or longer. The important indicate is that your choice expires inside this period considering the Bollinger Bands only create predictions for this period.

When you lot remember about trading an option with an decease of 15 minutes, you need to use at least a 15-minute nautical chart. If ten minutes have already passed within the current period, you have to switch to a 30-minute chart to guarantee that yous option expires within the current catamenia.

All you accept to practise to execute this strategy is this:

- Set the period of your char to the length of your expiry.

- Analyse the upper and lower toll ranges of your Bollinger Bands.

- Observe a ladder option with a target toll exterior these boundaries.

- Predict that the market will be unable to reach this price level.

For example, presume that an asset is trading for £100. The upper Bollinger Band is at £101, and the lower band is at £99.5. Your expiry and your chart menstruum are 30 minutes, and no time has passed in the current period.

- If your broker offers a ladder option with a target price of £101.5, yous know that the target price is outside the range of the Bollinger Bands. Consequently, you should invest in a depression option based on this target price, thereby predicting that the market will be unable to accomplish this price level.

- If y'all broker offers a ladder option with a target price of £100.5, you know that the target price is within accomplish of the Bollinger Bands. This target cost would be a bad investment based on this strategy.

With this strategy, y'all will go relatively low payouts. Since you lot should be able to win the overwhelming majority of your trades, you should be able to make a profit nonetheless.

Summary

Lagging indicators are an important aspect of whatever market assay strategy. They offer certain indications virtually what has happened and let for quality predictions about what volition happen adjacent. Strategies based on trends, moving averages, and Bollinger bands have helped many traders create successful trading strategies.

Three Examples Of Strategies For Technical Indicators

To assistance you go started with binary options and technical indicators, hither are three examples of strategies that you tin can use.

One: Trading The Extremes Of The MFI/RSI

The Money Catamenia Alphabetize (MFI) and the Relative Strength Index (RSI) are simple to interpret technical indicators that are based on similar ideas. Both indicators are oscillators, and both calculate the strength of a movement by relating its current momentum to past momentum. The departure is that the MFI also considers the volume while the RSI focuses on price action alone. Pick the indicator you like ameliorate; information technology will brand little departure to your terminal strategy.

Both the MFI and the RSI ascertain an overbought and an oversold surface area.

- When traders take bought an nugget for likewise long, the MFI and RSI assume that there are non enough buyers left in the market to go on to drive the price up. The marketplace is overbought and a turnaround probable.

- When traders have sold an asset for too long, the MFI and RSI assume that at that place are not enough sellers left in the market place to keep to drive the cost down. The market is oversold and a turnaround likely.

Based on this simple prediction, you can trade a binary selection. When your indicator of choice reaches an extreme value, invest in the opposite direction and predict that the market will turn effectually soon. Some traders besides invest when the market leaves an extreme surface area, arguing that information technology is better to invest in a reversal that has already happened (every bit indicated past the market's leaving the extreme area) than an impending turnaround (as indicated by the market entering the farthermost area). Some traders as well wait a few periods earlier they invest and see if the marketplace remains inside the farthermost area.

Ii: Trading Bollinger Bands

Bollinger bands are a great technical indicator for binary options traders because they clearly point toll levels at which y'all should look price actions.

Bollinger bands create a toll aqueduct that consists of iii lines. Those are:

- A moving average. The middle line of Bollinger bands is a moving average, usually based on 20 periods.

- An upper line. By calculation twice the standard deviation to the moving average, Bollinger bands create the upper line.

- A lower line. By subtracting twice the standard difference from the moving average, Bollinger bands create the lower line.

The result of this process is a price channel that surrounds the current market price. Each line works as a resistance or back up, depending on the direction from which the marketplace approaches the line.

- When the toll approaches a line from the tiptop, it works as a support.

- When the toll approaches a line from below, it works as a resistance.

Traders can trade these lines in 2 ways:

- Trade the impending turnaround. When the marketplace reaches a line, it volition likely be forced to plow effectually, at least briefly. Traders can merchandise this prediction and invest in a move in the reverse direction of the preceding movement. If you are using a high/low pick, remember that this is a curt-term prediction and utilize an expiry about the length of 1 period. You can as well employ a one bear upon option. In this case, make sure to use a target price no further than half the altitude to the next line.

- Trade the market's breaking through the middle line. The middle line is special because information technology tin can piece of work as a resistance or a support, depending on the market's electric current position in relation to the line. When the market breaks through the line, it changes its meaning. What was a resistance now becomes a support, or vice versa. Traders tin can profit from this significant outcome and invest in a binary option in the direction of the breakthrough.

This simple way of making money is ideal for newcomers. Experienced traders tin likewise add together another indicator to confirm the prediction made by the Bollinger bands, for instance a moving boilerplate.

3. Trading the Average Truthful Range (ATR)

The Average True Range (ATR) is a technical indicator that is perfect for traders of boundary options. Purlieus options are a special type of binary options because they are the only type that does not crave you lot to predict the marketplace'due south direction, which is perfect for traders who detect this type of prediction difficult.

Purlieus options ascertain two target toll in equal distance from the current market price. One in a higher place the current market price, one below it. Two win your pick; the market has to trigger either target price before your option ends. There is no need for it to remain at the price level, and information technology only has to touch i target price. Boundary options are one touch options with ii target prices.

With boundary options, your task is not to predict in which management the market volition move. Your task is to predict whether information technology volition move far enough to reach 1 of the two target prices. The ATR is the perfect indicator to brand this prediction.

The ATR does ane unproblematic thing: it calculates the average range of past marketplace periods. If the ATR has a value of 10 and you are looking at a nautical chart with a menstruum of 10 minutes, for example, the asset has moved, on average, 10 points every x minutes in the past.

You tin conform the number of periods you want the ATR to clarify. Most traders utilise a setting of fourteen periods, which means that the ATR calculates the average range of the last 14 periods of your nautical chart.

To trade boundary options based on the ATR, you lot only have to compare the ATR's reading to the target prices.

Permit's go back to our earlier case: in a chart with a period of 10 minutes, the ATR has a value of x. If your broker offers you lot an option with target prices that are 30 points abroad and an expiry of 1 hour, you know that there is a skilful risk that the marketplace will reach one of the target prices. Your reasoning would look like this:

- The market has moved 10 points per period.

- To accomplish a target toll in a straight move, the market would have to move 5 points per menstruation. (The choice has an expiry of lx minutes and you are looking at a 10-minute nautical chart. This means you take six periods until your option expires. The target prices are xxx points away. Divided past six periods, y'all go that the market would have to move an average of five points per period to get to the marketplace price in a straight line.)

- The marketplace'southward average movement per period is twice every bit high as the necessary movement to attain the target price.

- Generally, the market will never move in a straight line, merely if moves in the same direction for two periods in a row, it is well-nigh there. So in that location is a practiced chance that it will attain the target price.

As yous tin can see from this instance, you will always have to disbelieve the market'southward maximum achieve. If the market place moved in the same direction for hour, it would have a range of 60 points. This will never happen, which is why many traders use a discount factor. They multiply the maximum achieve with 0.five, for example, and when the target price of a boundary option is closer than the consequence of this equation, they invest.

You tin choose the discount factor according to your chance tolerance and feel. We recommend using a factor of 0.v or lower. Higher factors are besides risky.

Also, consider the payout y'all get for your option. Some brokers offer high-take chances boundary options (faraway target prices, higher payout) and depression-gamble purlieus options (shut target price, lower payout). Higher payouts allow you lot to trade profitably when you win fewer trades, which is why you can take more risks and use a college disbelieve factor.

Some traders as well use the Average directional movement index (ADX). The ADX indicates the trend strength on a calibration of 0 to 100. 0 indicates a complete lack of management, 100 that all periods point in the same direction. You can calculate your discount gene by dividing the ADX'due south value by 100.

- When the ADX reads 40, y'all use a discount factor of 0.4.

- When the ADX reads 70, you use a disbelieve factor of 0.7.

With this strategy, y'all adjust your discount factor to the current market environment.

Last Word On Technical Indicators

Technical indicators and binary options are a groovy combination. Technical indicators allow you to make brusk-term predictions in any market place; binary options enable you to trade these predictions more than profitably than other merchandise types.

As our examples of the MFI/RSI, Bollinger bands, or the ATR evidence, there is an indicator for whatsoever strategy. Find the correct indicator for you, and you take taken a big step towards condign a successful trader.

If you withal need a banker with which you lot can trade binary options, take a look at our top list of the best brokers;

Source: https://www.binaryoptions.co.uk/indicators

Posted by: normantione2000.blogspot.com

0 Response to "top binary option trading signals"

Post a Comment