binary options trading strategies for beginners pdf

Equally more and more people are turning to bitcoin and cryptocurrency trading, traders are starting to 'merchandise' these newer markets and increasingly add together them onto their spotter lists, especially as the price action data becomes more stable.

Today'due south lesson is an introduction guide into cryptocurrency trading for beginners and how you lot can trade bitcoin and the other newer cryptocurrencies. You tin become likewise go a FREE cryptocurrency pdf guide below. In this guide y'all'll likewise discover;

- How is trading bitcoin and cryptocurrency different to buying and which should yous do

- What are the advantages

- What charts should you be using

- Can you use price activity strategies in bitcoin markets? (and what strategies work).

- Bitcoins and cryptocurrency tips you need before starting trading

- And if you lot should trade Forex, cryptocurrency or both.

Free PDF Guide: Become Your Crytpocurrency For Beginners PDF Trading Guide

Agreement Cryptocurrency Trading

In recent times we take seen new products being launched such as the CME futures contract .

In that location are also planned Bitcoin ETF's which may or may not go approved.

These contracts and others that are all planned in the coming months are all planned to allow trading over the cost of bitcoins and not the bodily bitcoin itself.

This will also permit the possibility for a lot more people to commencement short selling and will also increase institutional trading.

Most retail traders a long time agone turned their attention away from trying to get their easily on bitcoins and instead started trading CFD'due south products on cryptocurrencies and bitcoins.

A Cryptocurrency CFD product allows you to become long or brusque without really holding the real Cryptocurrency.

This gives you the chance to gain exposure to the price of the Cryptocurrency without actually having to store it or worry about the counterparty take chances from the exchange.

In this fashion it is similar to trading Oil or Gilt. Rather than physically owning a barrel of oil or bar of Gold you are speculating on its price movements.

If you think price is going to go up you can make profits from a price rise and you can also accept reward from price making a price plummet lower past short selling.

Whereas property the real bitcoins your opportunities are actually limited. You cannot make profits from curt selling and become in and out fast like yous can with a CFD production and you cannot use leverage.

Annotation: Employ leverage with EXTREME circumspection on these products which is why I talk over take a chance management below. Whilst profits can exist increased, then can losses. It can also be used to protect you from loss if y'all apply smartly as we will discuss.

The other huge advantage of trading 'over' the price is that you don't have to have store any coins or worry about them getting lost or stolen. You lot can make it and out when you need and if all hell breaks loose and pandemonium breaks out, you are non left waiting two days to practise something with your bitcoins.

What are the Crypto Markets / Cryptocurrencies That Tin can exist Traded?

Bitcoin: BTCUSD

The biggest cryptocurrency and has a market cap of over 300 billion dollars.

Whilst toll has reached a record high of only under $xx,000 it currently sits around the $x,000 mark.

Some analysts are still extremely bullish on the prospects of the price of Bitcoin with some predicting $fifty,000 and others like Max Keiser predicting far higher prices.

Ethereum: ETHUSD

This is the second largest cryptocurrency and labeled by many every bit the next bitcoin. The currency has a lot of support and is a favorite amidst many.

Litecoin: LTCUSD

Litecoin was designed to be quicker and offering speedier processing times. Information technology was designed by a former Google engineer to meliorate upon the bitcoin technology and was the commencement cryptocurrency to implement SegWit

Dash: DHSUSD

This cryptocurrencies has infrastructure that enables far faster transactions than what the others practise. It has a focus on owner privacy and instant transactions.

Bitcoin Cash: BCHUSD

On August 1st, 2017, bitcoin experienced a fork that meant a make new cryptocurrency chosen Bitcoin Cash was created.

Bitcoin Greenbacks increased the limit to 8MB, assuasive for around 2 million transactions to be candy per day.

Cryptocurrency Trading for Beginners

Most traders are looking this fashion considering of the ease, speed, margin and money management.

Every bit Bitcoin and cryptocurrencies become more and more popular, the stories of fees increasing and extended wait times are becoming common.

Search a bitcoin forum or read a news site and you volition notice discussions about fees, talk nearly problems and problems like beingness able to purchase, but then struggling to sell.

For serious traders who are looking to make profits, high fees, slow trade times and being locked out of trades is a huge chance. It makes information technology very hard to manage the risks and know exactly what the downside could exist.

If yous are trading over the real toll with a CFD and not belongings the actual bitcoin, just making turn a profit from price going up AND downwards, yous tin can use gamble management strategies and hands get in and out with minimal fees.

What Charts Should I Use To Trade Bitcoin & Cryptocurrencies?

I of the best things about cryptocurrencies becoming so pop is that the adept charting platforms accept all jumped on board and and so have the all-time and biggest brokers.

Without these practiced brokers on lath it would be extremely hard to merchandise with price action trading strategies and create a profitable strategy. The bigger brokers bring far cheaper trading conditions with dependable charts that can exist relied upon.

You Can Download a Costless Demo MT4 or MT5 Charts to Merchandise Cryptocurrencies Hither

Best Brokers and What Leverage?

When yous are thinking most charts, brokers and starting to make trades in markets like cryptocurrencies, you need to think too about risk and leverage.

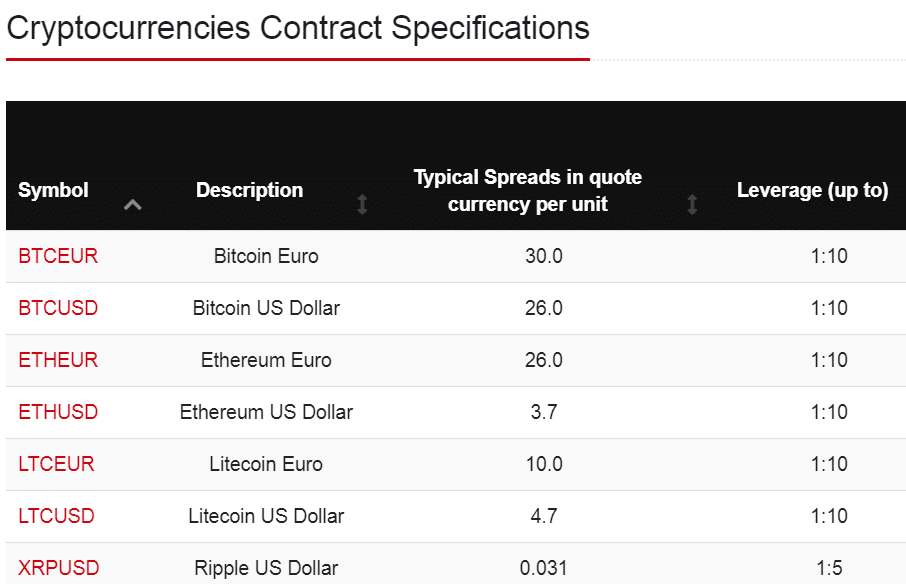

Brokers at the moment are mostly offer 1:10 to 1:xx leverage on cryptocurrency trading.

On Forex and other products information technology is common to run across leverage offered up to as high equally 500:one. With fourth dimension there is no doubt brokers volition start relaxing their strings especially as they go more experienced and comfy with the markets they are offering.

You need to apply leverage to your advantage and not accident your foot off with it. Whilst it can heighten your merchandise information technology tin also lead to far bigger losses.

The other affair to take into account is that you tin practice trading cryptocurrencies with a demo account and virtual money. This gives you the same market place weather, but the trades you lot are placing are with virtual money and non real cash. You don't demand to accident real live money to work out and test things.

For case; You can exist testing and working on things similar how much you demand to open trades, how much each move higher and lower is going to actually cost you.

Y'all want to practice getting the entries correct, where your stops should go, how to take profit, and manage trades. DON'T go into a live trade and go… "Oh No… I am really non certain what I am doing here!!"

You can become a costless virtual demo account to trade cryptocurrencies here.

HUGE TIP: Make certain you open up a demo account with the amount you intend to trade a real live account with. Don't open a demo account with $100,000 if yous only take $5,000 to trade with. Open a $5,000 business relationship and practice with information technology as if it is real.

Does Price Action Trading Piece of work on Bitcoin and Cryptocurrency?

Price activity at its simplest form is everything that traders are doing in a specific market existence played out on a nautical chart for usa equally a trader to read.

Keep in mind that a cost action trader may not just be reading price, but also using other tools and indicators to assist them make trades like moving averages, MACD and ATR.

As these are newer markets, the brokers took some time to go solid cost activity data into their charts and quality cost data. There is also non every bit much price history in the charts as what a lot of the Forex pairs have included.

When a lot of these cryptocurrency markets were first listed a lot of the cost action charts had extremely minimal price action data.

Over the months and years since, far amend price action has been added and price has likewise been trading forrard (adding more history into the charts) which has allowed traders to more accurately study it.

How Can I Utilize Price Action in the Crypto Markets?

Price action is condign increasingly clearer these markets get more and more than commonly traded.

This is because when a market has very minimal market participants the levels betwixt buyers and sellers is greater. You lot will encounter far more gaps, and far more random swings college and lower.

The back up and resistance levels will not exist every bit clear or defined and they will not be as respected as often. Every bit a whole the price nautical chart will look extremely sketchy. This is what near stock charts look like unless moving to higher time frames like weekly and to a higher place.

Every bit more than people have stepped into these crypto markets, spreads have dropped, and so has the gaps between where the buyers and sellers are; significant there is a lot more fighting going on to buy and sell than ever earlier.

This in plough creates better trading weather and a lot clearer and more than stable price action motion-picture show.

How Can You lot Accept Reward of This New Toll Action and Make Money?

Traders will practise the same things over and over again through fright, greed, panic and a whole heap of universal trading emotions and as they do these things, we will see it in the cost action. Traders can then 'buy and sell' to accept advantage accordingly.

For example; something happens in the earth and this causes people to buy upwards bitcoin and send toll higher. We will see this play out in real time as cost is moving college.

Another scenario is cost moves into a major level of supply or demand where huge orders are waiting and price moves higher or lower accordingly.

The same major market place principles use time and fourth dimension again because toll action is trader beliefs through the charts. It is there for you to watch, interpret so use to find profitable trades.

Should You Trade Price Action on Crypto and Bitcoin Markets?

The reason price action traders beloved Foreign exchange markets is considering of volatility or in elementary terms; a lot of price movement.

If price does not motility, a trader cannot profit. If toll is stuck in a range, a trader is stuck within that range. When price is making big moves in one particular direction, there are a lot of opportunities to make trades.

The cryptocurrency markets offer a lot of volatility and a lot of cost movement and this equals a lot of opportunity.

We are now start to see a lot more than potential intraday trades play out in these markets as they become more popular.

Should Yous Forget Foreign Exchange and Simply Trade Crypto Markets?

Forex is a five trillion dollar market that is not going anywhere. Every time you purchase something from overseas, or online, go on holiday y'all are using and swapping currency.

Every time international businesses make a bargain they deal and swap currency trying to get the best rates. Everyone from the biggest banks to the smallest retail traders trade Strange exchange. It does not close ever and offers unlimited potential as it continually roles on.

If y'all are looking to trade bitcoins and crypto markets, you could look at adding them on or complementing them to your Forex as a farther trading opportunity and yet some other market to brand profits from, just like Gold, Silvery, Oil etc.

Bitcoin 24 Hour – Sentinel the Gaps

What a lot of people exercise non realize is that both Foreign exchange and crypto markets practise non sleep or stop trading ever.

Foreign exchange is continually existence swapped and traded. Whist our brokers close, it does not stop trading hands. This is why you volition frequently open your charts up at the commencement of play Monday and see big gaps, and this can be even more than so with Bitcoin markets.

Very like to trading Forex, it is recommended y'all consider all your options and your trading strategy and goals before holding trades over the weekend. Whilst in Forex longer term positions can sometimes exist viable, in a market place where in that location can be huge percentage point swings, holding positions over the weekend can exist very risky.

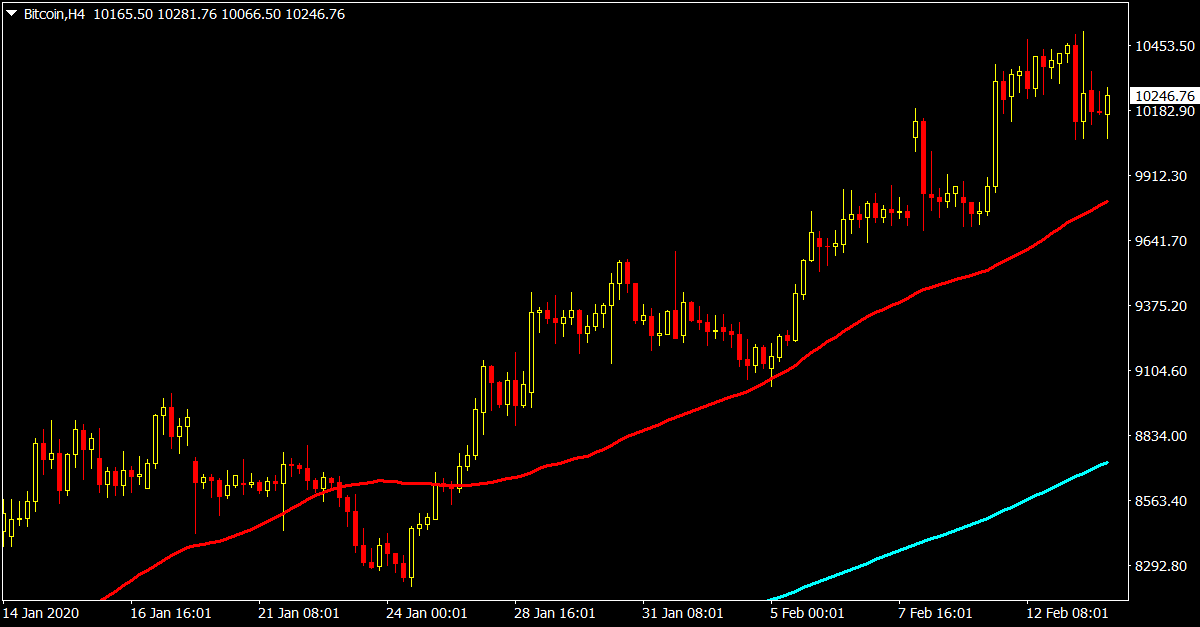

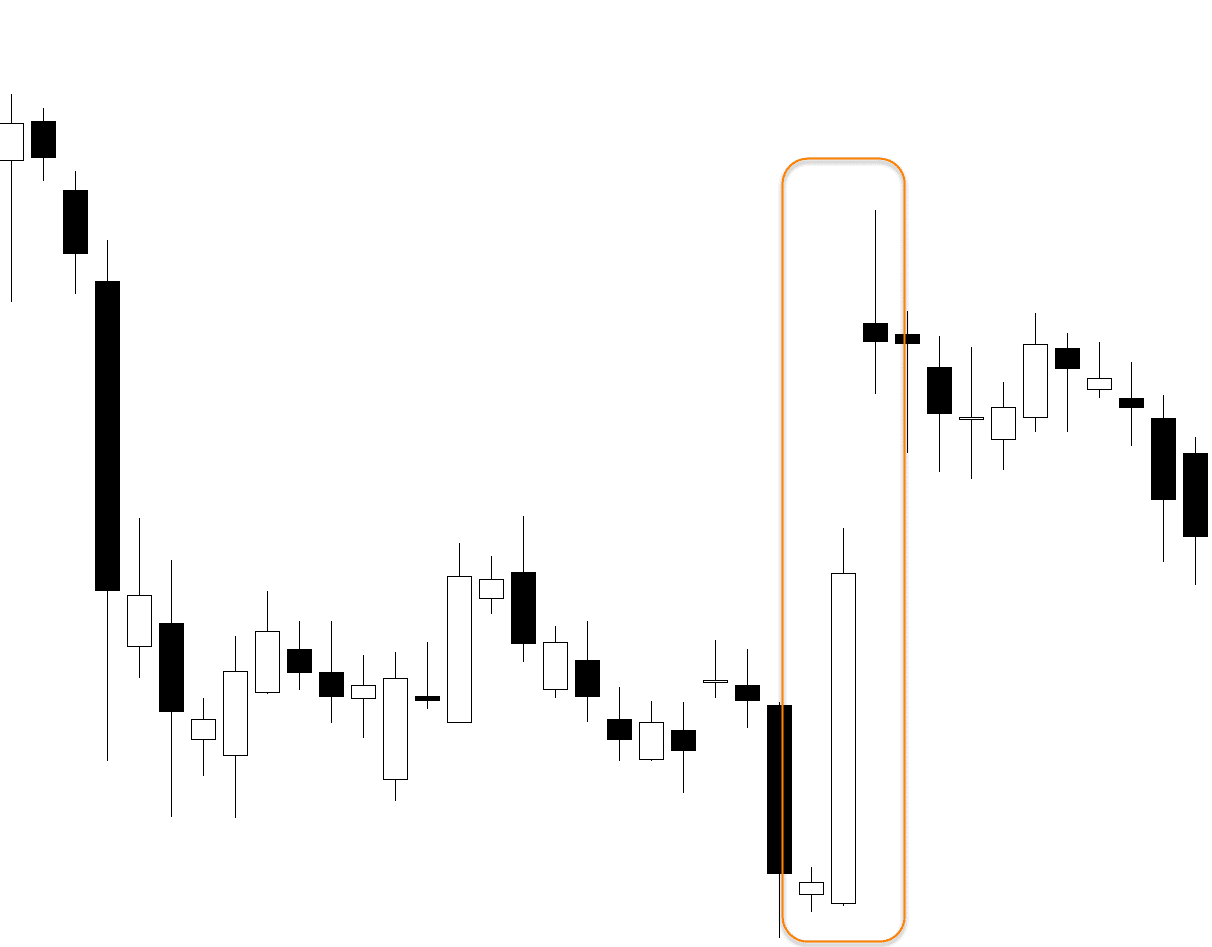

See the example below of a large gap created on the daily Bitcoin chart;

When you are trading on margin and using leverage you need to run the slumber exam; can y'all sleep over the weekend knowing you lot could exist wiped out with a huge gap come up Monday?

Probably not? Then close up and come back again at the start of play Monday and start trading.

If you are okay and comfortable with how things stand, so concord for the ride.

A side note to this is your personal and individual situation. You take to take into account your own goals and what you are trying to go out of the trade.

Costless PDF Guide: Get Your Crytpocurrency For Beginners PDF Trading Guide

Source: https://learnpriceaction.com/cryptocurrency-trading-for-beginners/

Posted by: normantione2000.blogspot.com

0 Response to "binary options trading strategies for beginners pdf"

Post a Comment