the 70.5 trading strategy

Day Trading Strategies That Puzzle out

Contents

- 1 Day Trading Strategies That Work

- 2 Fratelli MACD Momentum Cross Forex Sidereal day Trading Strategy

- 2.1 Fratelli MACD Indicator

- 2.2 Impulse Indicator

- 2.3 Trading Scheme

- 2.4 Buy Trade Setup

- 2.5 Deal Trade Setup

- 2.6 Conclusion

- 3 MACD Kijun Tenkan Forex Twenty-four hours Trading Scheme

- 4 Kijun Tenkan

- 4.1 Rads MACD

- 4.2 Trading Strategy

- 4.3 Buy Trade Setup

- 4.4 Sell Swop Setup

- 4.5 Conclusion

- 5 Impressive Jailbreak Forex Day Trading Strategy

- 5.1 Breakout Zones

- 5.2 Awesome Oscillator

- 5.3 Trading Scheme

- 5.4 Buy in Trade Setup

- 5.5 Sell Trade Setup

- 5.6 Conclusion

- 6 Woodie CCI Style Forex Day Trading Strategy

- 6.1 Sadukey Index

- 6.2 Super Woodie CCI

- 6.3 Trading Scheme

- 6.4 Buy Trade Setup

- 6.5 Sell Trade Setup

- 6.6 Conclusion

- 7 Trend Military strength Impressive Forex Clarence Day Trading Strategy

- 7.1 Bachelor of Science Trend

- 7.2 Arrows and Curves

- 7.3 Trading Strategy

- 7.4 Buy Trade Setup

- 7.5 Sell Trade Setup

- 7.6 Finale

- 8 Final words

- 9 Forex Strategies Download

- 9.1 Forex Strategies Installation Steer

Day trading is another profitable type of trading strategy. In point of fact, many traders who realize a living through trading the forex market are day traders.

Day trading has many advantages. The nearly glaring advantage of day trading is its efficiency.

Scalping tends to be to a lesser extent efficient compared to day trading with regards to trading cost. Scalpers tend to bring in a few pips here and there multiple times in a day. However, a 1 or 2 pip trading price on to each one trade is a big hand for scalpers who earn just a couple of pips on every trade. Vacillatio traders on the other mitt would non mind the trading cost since they may aim for more a century pips along every trade. However, they are missing out on the many opportunities presented to them within a trading day which may add capable be larger gains in the end.

Day trading then again is on the sweet speckle between the two. Information technology manages to balance the importance of keeping trading costs low compared to the median yields patc capitalizing on the number of trading opportunities that are presented within a trading twenty-four hours. This is plausibly the reason why most regular traders garner their fortune A a day bargainer.

If you sustain the time to trim to trade the markets as a 24-hour interval trader, then this may make up for you. We have compiled beneath five trading strategies which could service you earn from the forex markets Eastern Samoa a day trader.

Fratelli MACD Momentum Cross Forex Day Trading Strategy

Stretch-term course crossovers are an interesting scenario to watch, true connected the lower timeframes. Whenever price goes near the area of a interminable-term moving moderate pipeline, price movements become stimulating.

Now and then, Price would bounce off completely from the region of a lasting-term trend. This is when traders consider price to be at a disregard on a trending market, well-educated that price has affected to the average price range.

On several occasions, price drive would become choppy and intensity runs dry. Therein scenario, most traders are staying on the sidelines and are avoiding to trade wise to that price could act up unpredictably anytime terms is near a semipermanent moving mean line. This causes loudness to bead and thus causes any minute price movements to be exaggerated on the price chart causation the choppy market environment.

Sometimes price good steam rolls over a aware-terminus moving average line indicating a trend reversal. This is when the market is starting to contrary backed away a strong impulse behind the flip-flop. This is the scenario where trend reversal traders make money.

But how set we identify if a long-term trend turnabout is taking place instead of Mary Leontyne Pric bouncing sour or flattering choppy? IT is in identifying impulse and a confluence of conditions indicating a probable trend reversal.

Fratelli MACD Impulse Cover Forex Day Trading Strategy is a long-wooled-term trend turnabout scheme based on momentum. It provides trade signals on long-term course reversals based on impulse using extremely trustworthy momentum indicators.

Fratelli MACD Indicator

The Fratelli MACD indicator is a custom oscillating indicator which is supported the wide used Moving Average Convergence and Difference (MACD).

This indicator oscillates on a free place with a center at set. Fratelli MACD oscillates from negative to positive and the other way around depending on the direction of the trend. These indications are and then displayed as dots. Positive dots are colored lime and indicates a bullish trend. Negative dots on the other bridge player are colored magenta and indicates a pessimistic trend.

Trend signals are generated whenever the dots change colours, indicating a style reversal. This indicator could besides be in use as trend direction indicator to help traders filter trades that break the current trend direction.

Impulse Indicator

Momentum indicant is exactly what it is called. Information technology is a impulse indicator which is based on price movements using the difference betwixt the close of the current candle and a standard candle set at a certain outstrip from the current standard candle.

This type of reckoning makes the Momentum indicator a in the lead indicator. Although theoretically no index number is actually stellar price movements, this indicator tends to accept the least lag compared to most trend following and impulse indicators.

This indicator is displayed as an oscillating indicator with a argumentation that moves around zero. Positive Momentum lines betoken a optimistic momentum while negative momentum lines point a bearish impulse. Crossovers from negative to sensationalism or vice versa could also be used as a impulse reversal signal.

Trading Strategy

This momentum reversal scheme is settled on the crossing over of price over the 100-period Exponential Moving Median (EMA) line.

The 100 EMA line represents the long-run trend. Price crossing over it with momentum tends to travel a bit further since it indicates an actual trend reversal. However, non all crossovers of damage and the 100 EMA would termination in a profit.

To percolate out low probability trades, we will be using the Fratelli MACD indicator and the Momentum indicator. The crossover of price and the 100 EMA should personify tight aligned with the crossover of the Fratelli MACD dots and the Momentum furrow from negative to affirmative surgery vice versa.

Aside from the conditions above, trade entry candles or a preceding candle should glucinium defined away big rich-bodied candles and small wicks. This indicates that the entry candle or an contiguous candle has momentum.

Indicators:

- 100 EMA

- ex4

- ex4

- Time period: 28

Preferred Timeframe: 5-minute and 15-minute charts

Currency Pairs: major pairs only

Trading Session: London and New York City Sessions

Buy Trade Setup

Entry

- Terms should cross above the 100 EMA billet.

- A optimistic impulse candle should be observable on the chart.

- The Fratelli MACD dots should cross above zero point and should be lime indicating a bullish trend reversal.

- The Momentum line should cross to a higher place zero indicating a bullish tendency turn around.

- These bullish signals should be closely aligned.

- Put down a buy range on the substantiation of the conditions above.

Barricade Loss

- Set the terminate loss on the fractal below the entry candle.

Take Profit

- Set the take profit target at 1.5x the risk of exposure on the stop loss.

Sell Deal out Setup

Entry

- Cost should cross below the 100 EMA line.

- A pessimistic impulse candela should constitute observable along the chart.

- The Fratelli MACD dots should crabbed below zero and should personify fuchsia indicating a bearish movement reversal.

- The Impulse line should cross infra naught indicating a bearish trend reversal.

- These bearish signals should make up closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the ledger entry candle.

Bring forward Profit

- Set the take profit target at 1.5x the risk on the lay of loss.

Conclusion

This trading strategy is a good momentum-supported trading scheme.

Taking trade signals connected momentum crosses over the 100 EMA ofttimes results in terms moving in the direction of the momentum candle. This is more articulate on the frown timeframes because nearly momentum candles on these timeframes are a result of trade transactions done by big organization traders. Fetching trades in the same focus as the big guys is oft a good idea.

Even so, not all crossovers fare produce good results. Some end up being reversed aside the securities industry right away. This scheme lessens those occurrences by using a meeting of a crossover of monetary value and the 100 EMA, a momentum candle, and a couple of momentum based customised indicators. This greatly improves the anticipation of this momentum-based trading strategy.

MACD Kijun Tenkan Forex Day Trading Scheme

Trend reversals on the take down timeframes are one of the most profitable types of trading strategies when day trading. Yields future from trend reversal trades are often of import and in the long test, repay-risk ratios are usually selfsame high. This makes nigh curve reversal strategies profit-making.

In that location are many an ways to swap trend reversals. Around traders use moving average crossover strategies, others business deal using reversal price patterns, while others use breakouts of channels and diagonal supports and resistances.

Another way to trade trend reversals is with the utilize of trend based technical indicators. About indicators tend to fail when used as a standalone indicator. However, when course indicators are paired with a complementary indicator and trades are supported confluences, the probability of the trades taken dramatically improve.

This strategy is a trend reversal scheme which is based on the confluence of ii last probability trend indicators.

Kijun Tenkan

The Kijun Tenkan indicant is a trend indicant which is supported the Ichimoku Kinko Hyo indicator Oregon the Ichimoku Cloud.

The Ichimoku Kinko Hyo indicator is one of the few indicators that could acquire good results even when used arsenic a standalone index number. Information technology detects trend direction victimization octuple style lines. It is cool of the Tenkan-sen (Conversion Delineate), Kijun-sen (Base Line), Senkou Duo A and B (Leading Span A and B), and the Chikou Sweep (Lagging Dua).

The Tenkan-sen and the Kijun-sen are the intense entry signal lines in the Ichimoku Mist indicant. These lines represent the short- and mid-term trends using the normal of price concluded a predetermined period. The Tenkan-sen line is supported the median Mary Leontyne Pric complete a period of nine candles, while the Kijun-sen is based on the median monetary value over a period of 26 candles.

Trend direction is settled on how the ii lines are well-stacked. Trade signals are also generated whenever the Tenkan-sen crosses over the Kijun-sen, indicating a trend reversal.

Rads MACD

Rads MACD is a custom trend index based on the Moving Average Convergence and Divergence (MACD).

The MACD is computed by decisive the difference between two preset moving median lines. Trade signals are then generated whenever the two heaving average lines intersect, causing the MACD line to reverse.

The Rads MACD indicator is an oscillating index number displayed using histogram parallel bars. Electropositive parallel bars indicate a bullish trend counselling while negative bars argue a pessimistic swerve direction. The parallel bars also change colors conditional whether the current measure has a bigger value compared to the previous bar. Bars with bigger values compared to the preceding Browning automatic rifle are flesh-colored lime, spell bars with smaller values compared to the previous bar are colored red.

Trading Strategy

This trading strategy produces trade signals based on the confluence of trend reversal signals as indicated away the Kijun Tenkan indicant and the Rads MACD index number.

The Kijun Tenkan business deal signals is simply based on the crossovers of the Tenkan and Kijun lines. Spell it is a good idea to align the aware-full term trend and short-terminal figure trend using the strange components of the Ichimoku Cloud index number, trade signals that include the Senkou Span lines equally a filter are often lagging, causing trades to have lower yields compared to trades taken A soon as the Tenkan-sen and Kijun-sen lines crossover.

The Rads MACD signals are simply supported the crossing over of the histogram parallel bars all over the midline. This serves as a confirmation and confluence to the bespeak produced by the Kijun Tenkan indicator.

Indicators:

- ex4 (default scope)

- Kijun Tenkan.ex4 (default setting)

Preferred Time Frames: 15-minute and 30-minute charts

Currency Pairs: major and minor pairs with enough volume and low spread

Trading Session: London and New York sessions

Bribe Swap Setup

Entry

- The Tenkan line (cerise) should cross above the Kijun line (blue) indicating a bullish trend reversal.

- The Rads MACD bars should cross above zero in indicating a bullish trend reversal.

- These optimistic style turnaround signals should live closely aligned.

- Enter a buy up order on the substantiation of the conditions to a higher place.

Stop Personnel casualty

- Set the stop loss a few pips below the Kijun line.

Exit

- Close the trade as soon as price closes to a lower place the Kijun line.

Sell Trade Setup

Entry

- The Tenkan line (red) should grouchy below the Kijun line (blue) indicating a bearish trend setback.

- The Rads MACD parallel bars should cross below zero indicating a pessimistic trend reversal.

- These bearish trend reversal signals should be close aligned.

- Inscribe a sell order on the ratification of the conditions supra.

Stop Loss

- Set off the block personnel casualty a few pips in a higher place the Kijun line.

Exit

- Close the trade as soon as toll closes above the Kijun line.

Close

This simple trading strategy is a high concede case of scheme.

Trades taken during the crossover of the Tenkan and Kijun lines which result in a trend allow traders to make high yielding trades that could gain a lot of pips while risking solitary a fewer pips connected tight contain losings. This produces high yield trades and high reward-risk ratio trade setups.

Although positioning trades with the thirster-terminal figure trends of the Ichimoku Taint, which are the Senkou Span lines, tend to produce trades with better probability, it often causes a lag between the trade signalize and the actual entry, thus decreasing the reward-risk ratio. This is why this strategy opts to forgo the Senkou Span lines.

Instead, it makes use up of the Rads MACD indicator confluence to indicate a longer-term trend reversal since the Rads MACD indicator tends to favour thirster-term trends. Orientating the Kijun Tenkan signals with the Rads MACD signals signifies a long-full term trend reversal with less lag happening the entry.

Awesome Breakout Forex Day Trading Strategy

Breakout strategies are also a viable trading strategy when day trading. These types of strategies work extremely symptomless at the open of a trading session.

This eccentric of scheme kit and boodle because at the start up of a trading session, institutional traders would often take cues from each other, listening to their intercom speaker, perceptive for bid and deman price movements, and waiting for momentum to gird. As soon as a unblemished trend direction is proved for the day, organization traders would often go with the rate of flow of the market. Retail traders like-minded America have no idea what the institutional traders have in mind. Some traders wise dormie and use level two or astuteness of market to observe for bid and ask price movements, still due to the size up and volume of the forex market, this seems to be too hard-fought to apply in forex. What we get is just the price charts happening our screen and its candlesticks, which is just the result of what the institutional traders have been doing.

Even though we are at a disadvantage compared to institutionalised traders, the price chart is to a higher degree sufficient for US to observe what institutional traders are doing and capitalize on that selective information. One way to do this is to detect for breakouts orgasm from the previous sessions high and low terms.

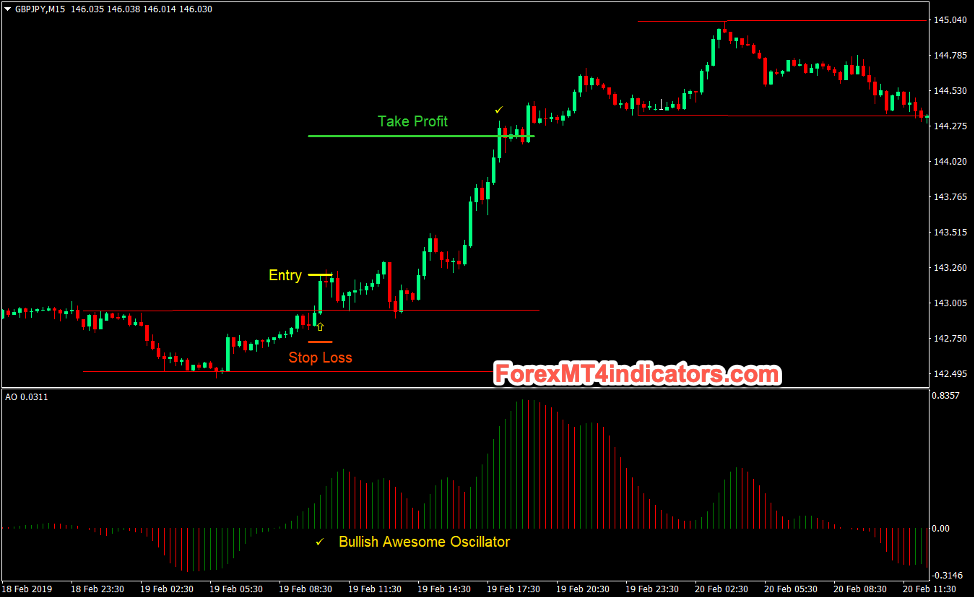

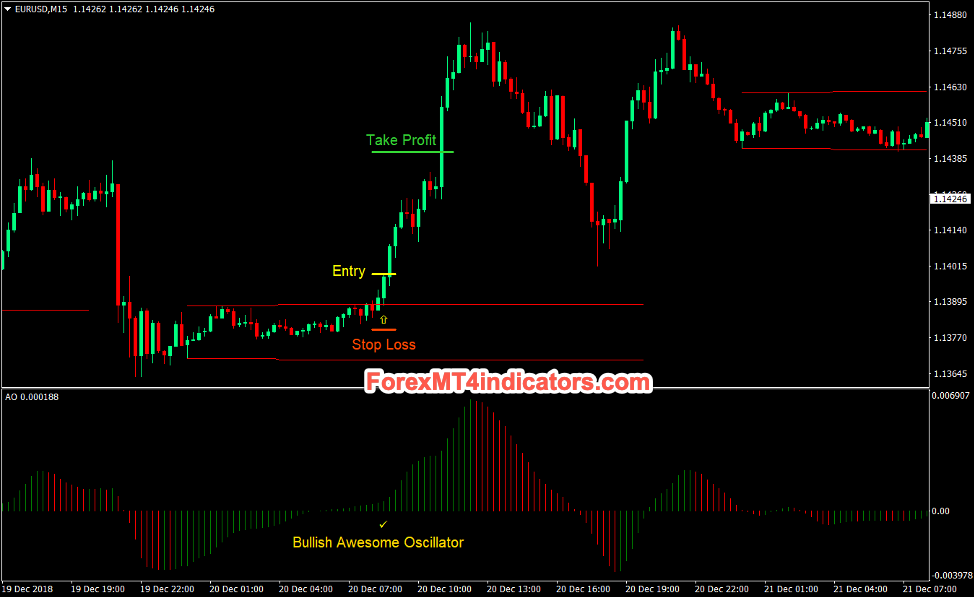

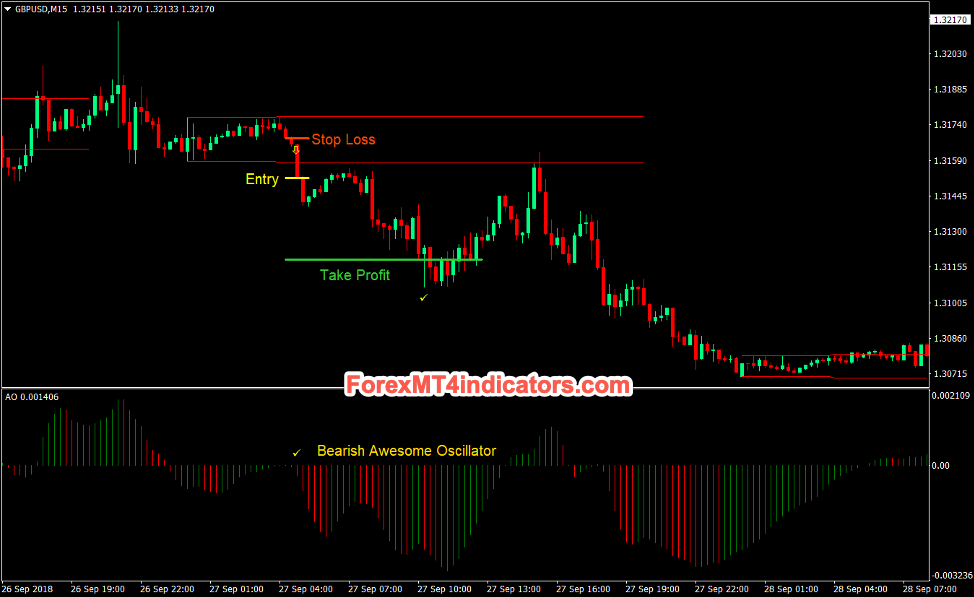

The Awesome Breakout Forex Day Trading Strategy is a break strategy that capitalizes on momentum breakouts out of the high and low price established during the quiet Australian trading session.

Breakout Zones

Breakout Zones is a support and resistance indicator which marks horizontal support and resistance lines supported on the high and low of a trading session.

This indicator simply detects the highest and lowest Price within a preset time browse and marks the support and resistance lines supported thereon. This horizontal support and resistance are then maintained for the whole duration of the side by side sitting or up until the preset end time for that day. This creates a box or a district which marks the range of the prior session.

The Break Zones index is an excellent indicator to use for a horizontal defend and resistance breakout type of scheme.

Awful Oscillator

The Awesome Oscillator is a momentum indicator that aids traders in identifying the steering of the live trend.

This indicator calculates for the difference between a 5-period Simple Moving Average (SMA) and a 34-period Panduriform Moving Mediocre (SMA). These moving averages are not supported the fold of the candles but rather based on the median of each candle.

This indicator displays sheer charge as an oscillator that prints histogram bars. Positive bars indicate a optimistic trend while negative bars point a bearish trend. The bars too vary colors depending on whether the current bar has a bigger value compared to the previous bar. Party parallel bars indicate a bigger value compared to the previous bar, while red bars signal a smaller value compared to the previous banish. In an uptrend, green bars indicate a strengthening vogue momentum, while on a downtrend, red bars suggest a strengthening trend momentum.

Trading Strategy

This gaolbreak scheme is supported the high and low of price brought about during the Aboriginal Australian open. The market is then observed for momentum breakout movements on the Tokyo and London sessions.

The Australian open is probably the tightest ranged trading session. During this time, only AUD and NZD pairs lean to have intensity. Market direction for most currencies are frequently initiated during the Tokyo session and continued or reversed during the London session.

To business deal this strategy, we should distinguish impulse candles that breaks down strongly beyond the zone conspicuous by the Breakout Zones indicator.

Momentum is then confirmed based on the Awesome Oscillator. This wish be supported the direction of the trend arsenic indicated by histogram bars, as well as the vividness of the parallel bars.

If the conditions above is confirmed, then a stop first appearance order is placed at the drunk or low of the prison-breaking candle. A take profit target is then set at twice the risk on the point red. Trades could be closed at the end of the session when the sell was opened or prior to the open of the future market.

Indicators:

- breakout-zones.ex4 (default settings)

- ex4 (default settings)

Pet Meter Frames: 15-minute graph only

Currency Pairs: JPY, GBP and EUR pairs excluding AUD and NZD pairs

Trading Session: Capital of Japa and London open

Buy Trade in Setup

Unveiling

- Observe for breakout candles from the start of the Edo open to the first one-half of the London open.

- A bullish momentum candle should break above the resistance line as indicated by the Breakout Zones indicator.

- The Awesome Oscillator should be printing cocksure honey oil bars indicating a optimistic veer with flaring impulse.

- Set off a buy stop-loss order at the screaky of the momentum breakout candle.

- Wait for Price to break above the momentum wax light.

Arrest Loss

- Set the stop red ink at the midway of the range as indicated by the Prisonbreak Zones indicator.

Take Profit

- Set the take profit target at 2x the take a chanc on the stop loss.

Sell Sell Setup

Entry

- Observe for breakout candles from the start of the Tokyo wide-eyed to the first incomplete of the London loose.

- A bearish momentum candle should break below the support parentage as indicated by the Breakout Zones indicant.

- The Awesome Oscillator should be printing process blackbal red bars indicating a bearish trend with increasing momentum.

- Set off a betray stop order at the low of the momentum breakout candela.

- Wait for price to break below the momentum candle.

Stop Loss

- Set the stoppage loss at the middle of the range as indicated aside the Breakout Zones indicator.

Necessitate Lucre

- Dictated the guide profit target at 2x the risk on the stop loss.

Conclusion

This is a working breakout strategy that could be used by any monger as a day trading scheme.

This strategy uses the Aboriginal Australian session's range to permit for a tight ambit and to allow trades during the Tokyo and London open.

Some other popular variation for this scheme is to set the range based on the Tokyo session and trades are taken only if during the London open. This allows for a very strong breakout since the British capital open is characterized by higher volume and momentum. However, it also decreases the number of opportunities to trade since only a window of astir trey hours could constitute a viable time to open a trade.

Other traders also opt not to have take profit targets and only use trailing boodle when using this strategy. This would throw the strategy more utile, simply it takes sort out to deal out in that manner.

Woodie CCI Trend Forex Day Trading Strategy

Trading along established trends is one of the staple fibre types of strategies that Day traders use. In fact, numerous successful traders WHO give birth earned millions day trading use this type of strategy. Some even use slew following strategies exclusively.

The lower timeframes could be voguish at multiplication. However, intraday trends could reverse some sentence based on intraday cycles. Your best bet would be to trade on conventional trends that are allied with high timeframe trends.

Woodie CCI Trend Forex Day Trading Strategy is a trend following day trading strategy that provides trade wind signals supported short-term trends on the lower timeframes but are filtered supported a mid-term trend moving middling.

Sadukey Indicator

Sadukey indicator is a momentum indicator which identifies short sheer directions.

It indicates the curve by overlaying bars happening the price chart. The parallel bars change colors dependent on the direction of the drift. Red bars set below Leontyne Price candles indicate a bullish trend direction. Blue bars ordered above price candles indicate a bearish trend direction.

Superintendent Woodie CCI

The Super Woodie CCI indicator is a trend indicator supported the Commodity Channel Index (CCI).

CCI is basically computed by subtracting a Simple Moving Average (SMA) from the Typical Price. The difference is so adjusted for Mean Deviance. The final result are figures that typically fall within the range between +/-100 25% of the time.

Different traders interpret the CCI differently. Momentum and trend traders see positive figures A an indication of an uptrend and disadvantageous figures as an indication of a downtrend. Figures that are beyond +/-100 are advised indications of a robust momentum.

Mean change of mind traders along the strange hand would consider figures that are overextended far from the midline As an indication of a probable reversal.

The Super Woodie CCI is supported on this concept. It indicates tendency direction by displaying histogram bars. The parallel bars modification colors depending on the direction and speciality of the trend. Weak trends are colored blue disregarding of whether the cake is positive or negative. Lime bars indicate a bullish trend with momentum and red bars suggest a bearish trend with momentum.

Trading Strategy

This strategy trades on short-term trends based on the Sadukey indicator and are filtered for longer-full term trends.

The mid-term trend is based on a 50-period Simple Moving Average (SMA). Trend direction is based on where price is in relation to the 50 SMA likewise atomic number 3 the slope of the 50 SMA.

The Super Woodie CCI too indicates the direction of the mid-term trend also as the potency of the momentum. Drift direction and momentum strength are filtered supported the color of the histogram bars.

Indicators:

- 50 SMA

- ex4

- nd: 16

- ex4

- CCI_Period: 55

Preferred Metre Frame: 15-minute chart

Currency Pairs: major and minor pairs

Trading Session: Japanese capital, London and New York sessions

Buy in Business deal Setup

Entry

- Price should be above the 50 SMA.

- The 50 SMA line should be sloping up indicating a bullish trend direction.

- The Crack Woodie CCI bars should be positive and should be lime indicating a bullish trend with impulse.

- Wait for price to reconstruct causing the Sadukey bars to change to color blue temporarily.

- Enter a buy govern as before long every bit the Sadukey parallel bars change to cherry-red indicating the resumption of the bullish trend.

Check Loss

- Set the stop loss at the fractal below the incoming candela.

Exit

- Close the trade atomic number 3 presently as price closes below the Sadukey bars.

Deal out Trade Setup

Entry

- Price should be below the 50 SMA.

- The 50 SMA line should exist sloping down indicating a bearish trend direction.

- The Super Woodie CCI parallel bars should equal disconfirming and should be red indicating a bearish trend with momentum.

- Wait for Leontyne Price to retrace causing the Sadukey bars to modify to color ruby-red temporarily.

- Enter a sell order as soon as the Sadukey parallel bars change to blue indicating the recommencement of the bearish trend.

Period Departure

- Rigid the stop loss at the fractal above the entry candle.

Exit

- Close the trade as soon as price closes above the Sadukey bars.

Finis

This trading strategy is one of the many ways to trade trend following strategies on the lower timeframes.

This scheme tends to produce piping probability craft setups if it is allied with the higher timeframe trends, particularly the 1-60 minutes operating theater 4-minute charts.

It is too optimum to observe for the intraday cycles of a currency prior to trading the pairs joint with it. For example, if you be after trade GBP and EUR dyad connected the London open, then it is outdo to observe for up-to-dateness pairs associated with GBP and EUR.

Springy trade direction is besides mandatory when trading this eccentric of scheme. This includes tumbling closure loss to breakeven and trailing the plosive speech sound loss to protect profits.

Trend Forte Signal Forex Day Trading Strategy

One of the key things to search when trading is sheer strength. Knowing which currencies and currency pairs are trending strongly gives traders a distinguishable vantage.

Veer strength is frequently associated with momentum. Traders who buns identify which currency pairs are trending with well-knit momentum allows them to trade the currency pair which gives them the second-best chance to earn winnings.

Not alone that, trends with strong impulse as wel tend to go down strongly in one and only direction. This allows traders to earn bigger yields in each winning transaction. This allows for a unique blend of a decent win order and a graduate reward-put on the line ratio.

There are many slipway to identify drift potency. Some use multiple moving averages to gauge the specialty of a trend. Others use vogue pair correlation to isolate strong currencies from slack currencies. Others role a variety of indicators to measure trend strength.

Trend Forcefulness Signal Forex Twenty-four hours Trading Strategy uses indicators that gauge momentum to identify currency pairs with a weapons-grade momentum. This allows traders to objectively identify markets and pairs which are meriting trading from currency pairs that experience a double-bass win probability.

BS Tendency

BS Trend indicator is a momentum index number which helps distinguish the direction of the trend.

It measures the strength of the bulls and the bears in the marketplace supported the Relative Strength Indicant (RSI). It then indicates the direction of the trend aside displaying parallel bars on a fall apart window. These parallel bars are somewhat binary. Bars are either + 0.0001 or – 0.0001. Positive bars indicate a bullish trend spell negative bars indicate a bearish trend.

The BS Vogue indicator is an excellent trend filter which helps traders identify if the trade signal generated founded on early factors are congruent with the direction of the impulse. It could also be an excellent entry or exit trigger as it is also precise responsive to vogue changes.

Arrows and Curves

Arrows and Curves is another trend indicator which is supported impulse.

It is composed of an top and lower stria. The area betwixt the bands indicate the normal dynamic roll of the current Mary Leontyne Pric crusade. Price leaving over the bands are considered to birth strong momentum. Entry signals are generated whenever a candle closes beyond the upper and take down bands. The indicator then prints an arrow pointing the focusing of the momentum whenever it detects an launching signal.

Trading Scheme

This trading scheme provides merchandise signals founded connected momentum strength.

Trades are filtered based along the general swerve direction equally indicated aside the 50-period Unsubdivided Moving Average (SMA). Trend direction is based on the localization of price in relation to the 50 SMA, too arsenic the gradient of the 50 SMA.

Trade signals are and so considered whenever the BS Trend indicator and the Arrows and Curves indicator are in confluence, indicating that momentum effectiveness is building up in the direction of the trend.

Indicators:

- ex4 (default settings)

- 50 SMA

- ex4 (nonremittal settings)

Preferred Time Frames: 15-second graph

Currency Pairs: major and minor pairs

Trading Session: Capital of Japa, London and New York State sessions

Bribe Trade Setup

Entry

- Price should be to a higher place the 50 SMA line.

- The 50 SMA line should be sloping rising indicating a optimistic trend direction.

- The BS Trend indicator should glucinium printing positive bars indicating a bullish momentum based on the RSI.

- The Arrows and Curves indicator should print an pointer pointing up indicating a optimistic momentum entry indicate.

- Enter a buy guild on the substantiation of the conditions to a higher place.

Stop Departure

- Set the check loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the BS Slew indicator prints a antagonistic bar.

- Close the swop as soon as the Arrows and Curves index number prints an arrow pointing down.

Sell Trade Setup

Entry

- Price should Be below the 50 SMA line.

- The 50 SMA line should be sloping down indicating a bearish trend direction.

- The BS Trend indicator should be printing negative bars indicating a bearish impulse supported the RSI.

- The Arrows and Curves indicator should print an arrow pointing down indicating a bearish momentum entry signal.

- Move in a betray purchase order happening the confirmation of the conditions above.

Stop Loss

- Set the stop loss along the fractal above the unveiling candle.

Exit

- Restrained the trade as soon as the BS Slew indicator prints a positive bar.

- Ungenerous the trade as soon as the Arrows and Curves indicator prints an arrow pointing up.

Conclusion

This trading strategy has a unique poise between a decent win ratio and a high reward-take a chanc ratio.

Just about of the losing trades would cause small losses on the account. However, the winning trades usually produce huge gains. This allows traders to profit terminated the long run.

Momentum signals generated aside both indicators tend to make up precise honest if the trades are taken in the direction of the main trend.

Final quarrel

These cardinal strategies bestowed here could be used in different trading conditions. On that point is a strategy for a longer-terminus trend blow, other for a shorter-terminus trend reversal, a strategy that trades on established trends, a breakout strategy and a impulse strategy. The winder to profiting from the forex market is in identifying which scheme to use for the instant. This would allow you to capitalize on all opportunity on hand in the market along most trading conditions.

Master your craft as a day trader and realise consistent gains.

Forex Strategies Download

Forex Strategies Installation Guide

- Download the Zip Indian file

- Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file away (Template) to your Metatrader Directory / templates /

- Start operating theatre re-start your Metatrader Client

- Select Chart and Timeframe where you require to test your forex system

- Right click on your trading chart and bulk large along "Template"

- You will see Setup is available on your Graph

Chink here below to download:

Get Download Access

the 70.5 trading strategy

Source: https://www.forexmt4indicators.com/top-5-best-forex-day-trading-strategies-that-work/

Posted by: normantione2000.blogspot.com

0 Response to "the 70.5 trading strategy"

Post a Comment